Data Capture Insights

Dive deeper into topics like computer vision and machine learning and get to know our products

Stay up to date!

Receive monthly news about our products and the latest software updates.

Latest Post

Trucking apps: Must-have features for boosting driver productivity

We examine the prevalence of trucking apps in the industry and explore their specific functionalities.

Read PostView all

Product

Technology

11 min

Trucking apps: Must-have features for boosting driver productivity

We examine the prevalence of trucking apps in the industry and explore their specific functionalities.

Read post

5 min

Behind the Scan: Amazon Shopping – uncovering how barcode scanning makes online shopping a breeze

Join us as we take a closer look at the Amazon app's built-in barcode scanning feature and evaluate it's performance.

Read post

4 min

5 reasons to build an in-house driver app

Explore why building a driver app in-house offers control, smoother integration, cost savings, and brand consistency.

Read post

4 min

Top logistics trends in 2024: Harnessing key technologies to connect, automate and optimize modern logistics

Better and broader interconnectivity, digital platforms, and data analysis drive digital trends in the logistics sector. What are the cornerstones enabling this digital shift?

Read post

5 min

Streamlining event entry with a mobile ticket barcode scanner

Adopting technology for the event ticketing process ensures a smooth experience. Learn how the Scanbot SDK can help boost your event entry process.

Read post

7 min

US trucking apps under the microscope: what drivers want

We analyzed real user feedback and identified areas where developers and trucking companies still need to improve.

Read post

5 min

Top barcodes in the post, parcel, and delivery industry – and how to scan them

Barcodes are changing logistics. Learn how they ensure seamless parcel delivery with real-time tracking, enhance efficiency and increase customer satisfaction.

Read post

4 min

Embracing the future of retail: How retail automation technology is reshaping the shopping experience

Learn how mobile barcode scanning can help brick-and-mortar stores stay competitive in the e-commerce era.

Read post

3 min

Ensuring efficiency and security in legal document management

For legal enterprises, replacing traditional paper-based document management with digital workflows has become vital to staying competitive. The burden of manual document handling, physical storage, and the need for[...]

Read post

3 min

Enhancing construction management efficiency through digital innovation

Enhance construction management with the help of software tailored to the industry’s needs. Learn how mobile scanning can contribute to that.

Read post

6 min

Optimize your inventory management: How to implement a barcode system for your inventory

As a company grows, so does its inventory. Eventually, businesses need to find digital alternatives to collect and manage that data. Barcodes offer the best basis for this. Let's[...]

Read post

3 min

Maximize your document processing rates with our Document Scanner SDK’s new image filters

We've significantly improved the image filter options of our Document Scanner SDK to increase the processing speed on the device and help make scanned documents even more human- and[...]

Read post

2 min

We’ve teamed up with Cypher Robotics to automate inventory cycle counting

We're glad to announce a partnership with Cypher Robotics, a company specializing in autonomous robotic solutions.

Read post

2 min

We developed a new Web Document Scanner Demo – try it for free

The new Web Document Scanner Demo lets you test our SDK in any modern browser like Chrome, Firefox, Safari, or Edge.

Read post

3 min

Integrate barcode scanning into your app in record time with our new RTU UI v.2.0

It’s now even easier to provide your users with an intuitive scanning interface without having to build it yourself!

Read post

4 min

Digital transformation trends in the insurance industry for 2024: Robotic process automation and beyond

From leveraging customer data to robotic process automation: Learn how insurers are enhancing efficiency and customer satisfaction this year.

Read post

5 min

BYOD vs. CYOD – 2 approaches compared

In this blog post, we provide an overview of these approaches – and showcase the challenges and opportunities that come with them.

Read post

5 min

GS1 Barcodes: What they are and how to scan them

A GS1 barcode conforms to standards defined by GS1, which ensures both the barcode's global uniqueness and its compatibility with software systems.

Read post

5 min

Mitigating self-checkout theft: A comprehensive guide for retailers

As self-checkout grows in popularity, retailers must address the unique shoplifting challenges associated with these technologies. This guide explores strategic measures to mitigate self-checkout theft.

Read post

4 min

How to build an air travel app

This comprehensive guide will walk you through the step-by-step process of creating an air travel app with advanced features that benefit travelers and employees alike.

Read post

6 min

1D vs. 2D barcodes – benefits and drawbacks of one- and two-dimensional symbologies

Which kind of barcode is better suited for your needs, one- or two-dimensional ones? Let's look at the advantages and disadvantages of both – and whether there is a[...]

Read post

4 min

Improving the ticket scanning process in public transport with Mobile Barcode Scanning

Simplify ticket processes for efficient and stress-free commuting. Discover how you can improve this process with the Scanbot Barcode Scanner SDK.

Read post

6 min

How to build a retail app: a step-by-step guide

As consumer preferences shift towards digital channels, a well-designed retail app can be a game-changer for corporations looking to enhance their reach and customer engagement. In this guide, we'll[...]

Read post

4 min

6 ways to use barcode scanning in and outside the classroom in 2024

Technology is transforming how we approach education. Barcode scanning offers exciting possibilities to enhance the learning experience in and outside the classroom.

Read post

4 min

Increasing customer satisfaction – step by step

In this blog post, you will learn about several strategies and approaches you can use to increase customer satisfaction and promote long-term success.

Read post

5 min

Business process optimization: boosting efficiency in your company

By streamlining their operations, companies can reduce expenses and improve their goods or services. This blog post will show you how to consistently improve your operations and why process[...]

Read post

5 min

Is self-checkout a failed experiment? Our data says otherwise.

More than 30 years after the introduction of the first self-checkout registers, this technology still hasn't replaced traditional checkout, leading some to consider it a failed experiment. But is[...]

Read post

3 min

Introducing our enhanced Document Quality Analyzer

Our new Document Quality Analyzer makes it easier to accurately gauge whether a scanned document is fit for further processing. Learn more about how it works.

Read post

5 min

Agribusiness technology: How mobile scanning yields better monitoring and asset management

The agricultural sector has benefited immensely from advances in digital technologies. We'll take a closer look at what digitalization means for agribusinesses and how mobile scanning can further improve[...]

Read post

5 min

How to read damaged or blurry barcodes

As barcodes are used in all kinds of environments, they are susceptible to being scratched, deformed, or rendered illegible in other ways. Let’s look at the most common problems[...]

Read post

8 min

2023 recap: Scanbot SDK’s year in review

Let's take a look back at the new products we've released in 2023 and a few examples of noteworthy content that you may have missed.

Read post

5 min

Streamlining input management with the Scanbot SDK

The Scanbot Document Scanning SDK seamlessly bridges the gap between document submission and processing. Discover how our SDK empowers businesses from a variety of industries to streamline data handling,[...]

Read post

4 min

How postal barcodes work and how to read them

Barcodes are often associated with retail, but their importance for postal services cannot be overstated. Let’s take a look at the unique symbologies used to route and track mail[...]

Read post

5 min

Fintech solutions for mobile payments and beyond

From simplifying mobile payments to streamlining credit applications, the Scanbot SDK brings advanced scanning capabilities to your fingertips.

Read post

5 min

Optimizing inventory management with drone barcode scanners

Drone barcode scanners are an a cost-effective way for companies to streamline inventory management processes and increase warehouse efficiency.

Read post

14 min

Types of barcodes and their usage

An overview of the 1D and 2D barcode types supported by the Scanbot Barcode Scanner SDK and their use cases.

Read post

3 min

Enhancing insurance customer satisfaction with the Scanbot Document Scanner SDK

Increase productivity and streamline workflows with Scanbot SDK’s powerful scanning solutions. Learn more about our product and what users say about it.

Read post

5 min

The evolution of document scanning

The evolution of document scanning has been nothing short of remarkable. This technology has forever changed how we interact with and manage information, fostering greater efficiency and connectivity in[...]

Read post

4 min

How insurances can offer easy online document submissions using a Web SDK

Giving insureds the option to scan and submit documents via a web portal saves time and increases automatic processing rates.

Read post

4 min

Insurance agent apps: Scanning ID documents on the go

The ability to scan and upload documents directly from their mobile device helps insurance agents do their job more efficiently and flexibly. The benefits are better customer service, lower[...]

Read post

5 min

How airlines can unify above- and below-the-wing operations with a mobile scanning app

Learn how airlines can complement their existing scanning infrastructure by integrating mobile barcode, document, and data scanning into their internal apps.

Read post

8 min

Customer-driven excellence: a conversation with Malte Geuthner, Head of Customer Success at Scanbot SDK

Join us on a deep dive into the world of Customer Success with our Head of CSM, Malte Geuthner.

Read post

4 min

Safeguarding your digital workflows: The importance of data protection

Business growth depends on technology so protecting your data assets is vital. Learn why prioritizing data protection is now a strategic necessity.

Read post

5 min

A new chapter for Scanbot SDK: Unveiling our new logo and brand design

We have adopted a new design system, completely revamping our website and logo. Let's dive into the details!

Read post

4 min

QR code authentication: Enable secure logins with phone-as-a-token

QR code authentication is a form of user identification that utilizes the phone-as-a-token concept. It enables organizations to implement multi-factor authentication by generating QR codes that contain time-based one-time[...]

Read post

2 min

Meet our new .NET MAUI SDK

The Scanbot SDK is now available for the .NET MAUI framework for cross-platform app development.

Read post

5 min

Employee app features: Scanning functionalities turn your employee app into a multi-tool

We are in the midst of the digital age and handle a large part of our daily tasks digitally via different apps. Large enterprises have started to utilize modern[...]

Read post

4 min

Container OCR for logistics: Scanning ISO 6346 codes with a smartphone

A mobile scanning solution enables port personnel, customs officers, and warehouse staff to quickly ID containers wherever they are. Such a container code scanner can be installed on existing[...]

Read post

6 min

Advantages and disadvantages of a barcode reader

Barcode readers are faster and more accurate than manual data entry. But are handhelds or smartphones better for your use case? Here are the pros and cons.

Read post

6 min

How does deep learning benefit barcode scanning?

Deep learning models are perfect tools for barcode detection, improving on classic computer vision approaches. With some optimization, a high degree of accuracy can be achieved even on mobile[...]

Read post

4 min

Smartphones as data capture devices transform the future of mobile data collection

In this blog post, we’ll take a look at the advantages smartphones offer in comparison with conventional devices.

Read post

2 min

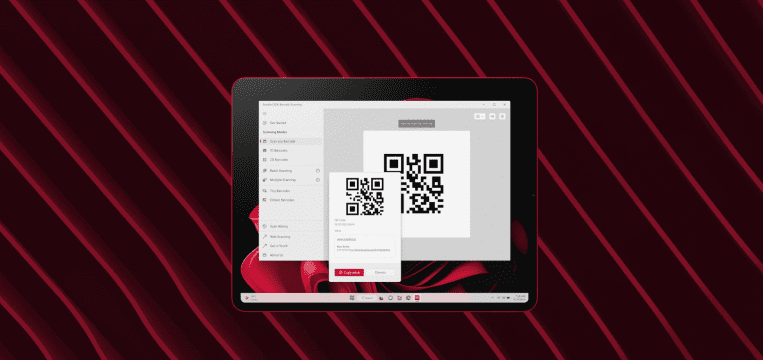

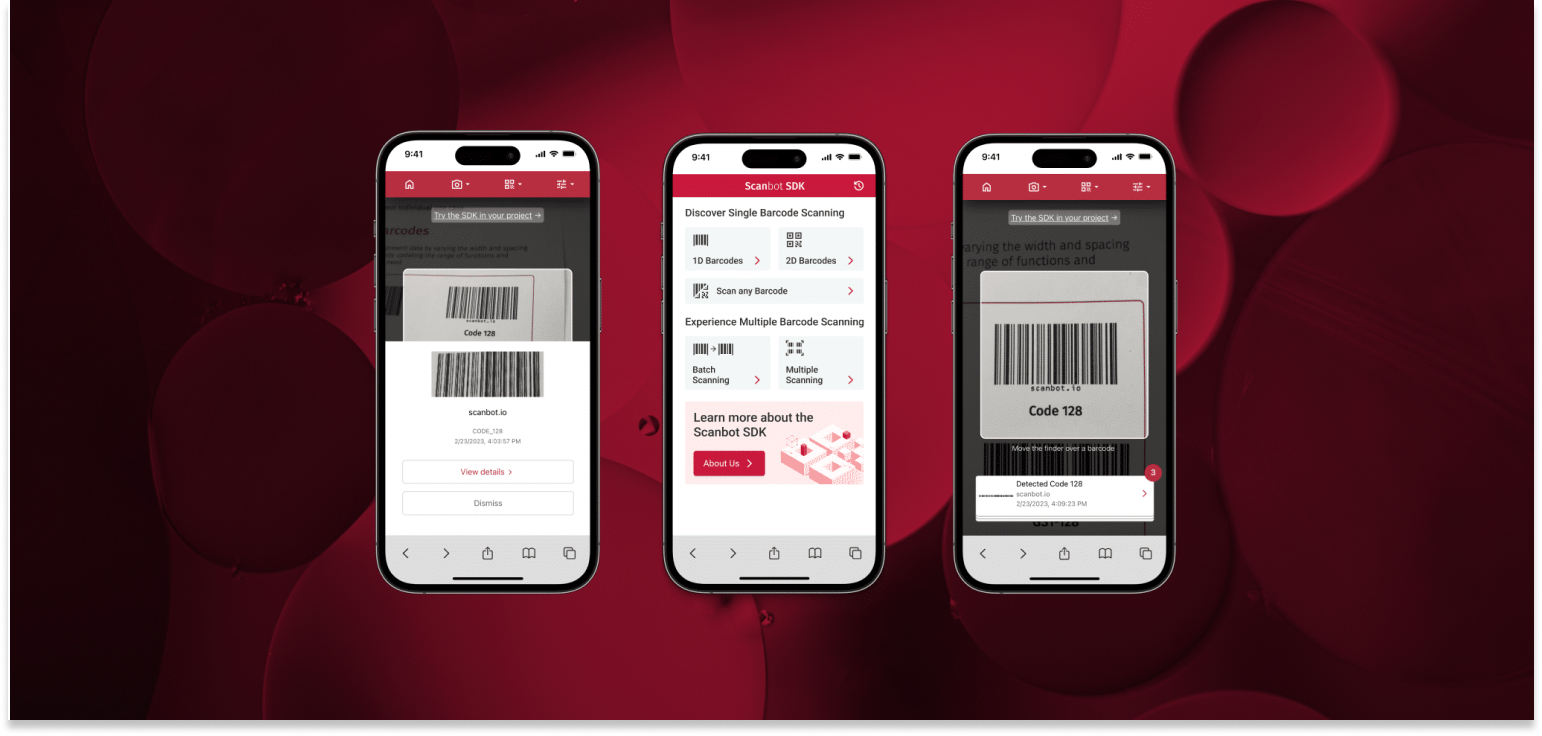

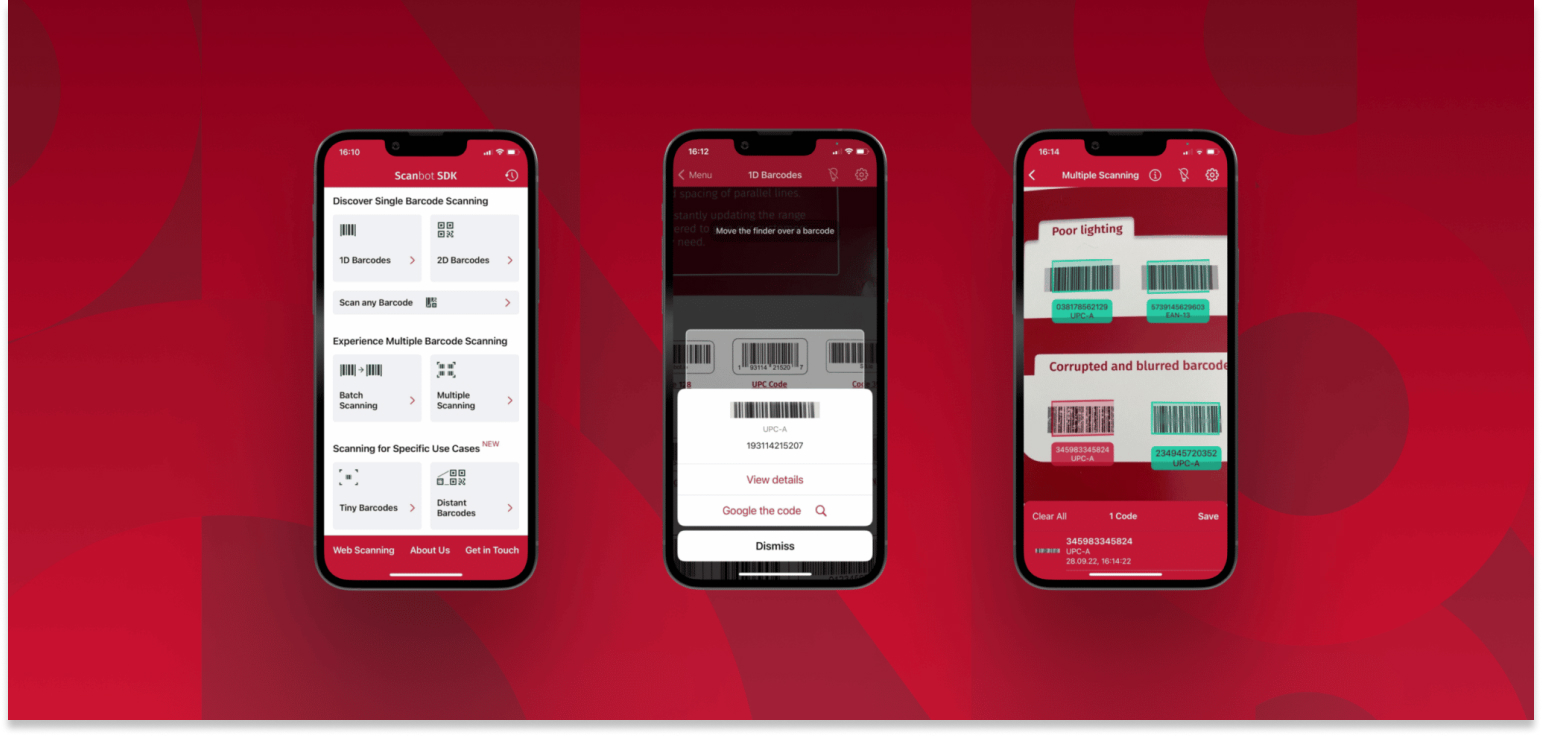

Our Barcode Scanner Demo App is now available on Windows

The "Scanbot SDK: Barcode Scanning" app is now available for free on the Microsoft Store.

Read post

4 min

Grocery list scanner: Smartphones are turning into smart shopping sidekicks

Discover how the shopping list of the future works – and what advantages it offers retailers.

Read post

10 min

CEO Christoph Wagner on Scanbot SDK’s core objectives & business model

Today, CEO Christoph Wagner shares insights into the key goal underlying Scanbot SDK’s product offering.

Read post

5 min

Leveraging the power of modern technology: 6 key benefits of mobile apps

In this article, we explore the key benefits mobile apps hold for companies and how they enable businesses to stay ahead.

Read post

16 min

Tipos de códigos de barras y su uso

[Spanish only] Descubre los diferentes tipos de códigos de barras: 1D para líneas simples y 2D para información más compleja. Aprende sus usos y cómo escanearlos.

Read post

5 min

How a pick-to-light system can massively increase warehouse throughput

Pick-to-light technology lets warehouse workers process more orders in less time and with fewer errors. Here, we take a closer look at how this system works and why it[...]

Read post

3 min

Machine learning in manufacturing: unlocking efficiency and innovation

In this article, we investigate machine learning's use cases, advantages, and potential for manufacturing businesses.

Read post

5 min

Scan magasin – Scanner les achats à l’aide de smartphones pour une expérience «Scan and Go»

[French only] Découvrez comment le système « Scan & Go » offre une expérience d'achat premium en magasin grâce à l'utilisation de smartphones. Explorez l'ère du Scan & Go,[...]

Read post

3 min

4 reasons why you should use mobile passport scanning

In this blog post, we take a deep look at the benefits mobile passport scanning brings to international travel and hospitality.

Read post

10 min

The Changing Face of Retail: A Survey of U.S. Consumers’ Multichannel Experience

We surveyed 1,000 American consumers about their preferences regarding online and offline shopping, multichannel retail, and self-checkout technology. Here are the results.

Read post

3 min

OCR for cloud storage: making data searchable

Let’s discover how modern technology can make your cloud storage searchable.

Read post

2 min

Preventing incorrect data entry with the EHIC Scanner SDK

Discover now how an EHIC Scanner SDK lets you bring your app services up to date.

Read post

13 min

Découvrez les différents types de codes-barres et leur utilisation

[French only] Dans cet article, vous découvrirez les types de codes-barres les plus courants et leurs caractéristiques.

Read post

9 min

Le Self-Scanning pour le commerce de détail

[French only] Comment transformer l'expérience d'achat en magasin et générer l'effet "WOW" auprès des consommateurs

Read post

4 min

The future of payment innovation: an overview of the most important trends

This blog article looks at the most recent payment innovations – and how they will affect business operations and consumer behavior.

Read post

3 min

Artificial intelligence in retail: How new technology is transforming the industry

In this blog post, we’ll take a closer look at how retailers use AI and the benefits it provides to both them and their customers.

Read post

2 min

Scan barcodes from your browser with our new Web Barcode Scanner Demo

Try out our Barcode Scanner SDK without having to install the app: The Web Barcode Scanner Demo runs directly in your browser!

Read post

4 min

Who invented the barcode? A dive into the history of the first product code

How and when was barcode technology invented? Let's go back to the 1950s to find the answer.

Read post

5 min

How do barcodes actually work?

Want to learn how to decode a barcode by hand? We'll take a look at its data structure and tell you how!

Read post

3 min

How telecommunication providers can benefit from barcode scanning in their field service management software

Making your internal field service management solution the one-stop shop for all your field service technicians’ needs cuts down on costs for specialized equipment, such as dedicated barcode scanners.

Read post

6 min

Open source scanner or proprietary SDK? An overview of the pros & cons

Companies that want to add scanning features to their mobile apps without developing them in-house can choose between open-source software and a proprietary SDK. Both have their pros and[...]

Read post

3 min

Scan shipping labels – say goodbye to outdated handheld scanners with the Scanbot SDK

Whether on the last mile or at the local post office – shipping label scanning must be efficient, especially during peak seasons. To stay competitive, postal services need to[...]

Read post

4 min

Turn your Windows tablets into powerful barcode scanners

Windows tablets can be used as powerful barcode scanners in enterprises. Find out which hardware features you should consider before deciding on a model.

Read post

4 min

Order and Pay made easy – QR Code Scanning for your mobile app

Let's explore the Order and Pay concept and discover how mobile QR Code Scanning enables an elevated, digital restaurant experience.

Read post

4 min

Barcode parser: How to parse GS1 barcodes, driver’s licenses, and more

Barcodes store data in a compact, machine-readable format. Learn how a barcode parser prepares multiple data elements for processing by the backend.

Read post

3 min

Hospitality solutions with mobile scanning: Elevate your guest experience now!

Digital services are a critical investment for hospitality businesses in 2023. Mobile scanning, for instance, lets you digitize countless daily processes, from check-ins to the dining experience inside your[...]

Read post

3 min

How “New Retail” is shaping the supermarkets of the future

Supermarkets in China have successfully tested an innovative business approach called “New Retail”. Learn more about how the supermarkets of the future will look like.

Read post

5 min

Turn smartphones into boarding pass scanners & streamline internal workflows

Smartphones and tablets allow for scanning boarding passes on the go. Let's dive deeper into the benefits of mobile scanning in the air travel industry.

Read post

4 min

Developing an effective fleet management strategy

Good fleet management is at the heart of every transportation company’s operations. Learn more about how to improve efficiency and productivity, increase driver safety, and eliminate unnecessary costs.

Read post

6 min

What is an MRZ (machine-readable zone)?

MRZs encode information on ID cards and passports in a machine-readable format. Find out how to automatically read MRZs with data capture software.

Read post

4 min

Make or buy decision – Benefits of third-party software providers

This guide will help you make a decision between SDK and custom code and demonstrate the benefits of a Software Development Kit.

Read post

5 min

2022 recap: Scanbot SDK’s year in review

We would like to cap off the year by looking back at 2022 and calling your attention to some highlights you may have missed.

Read post

2 min

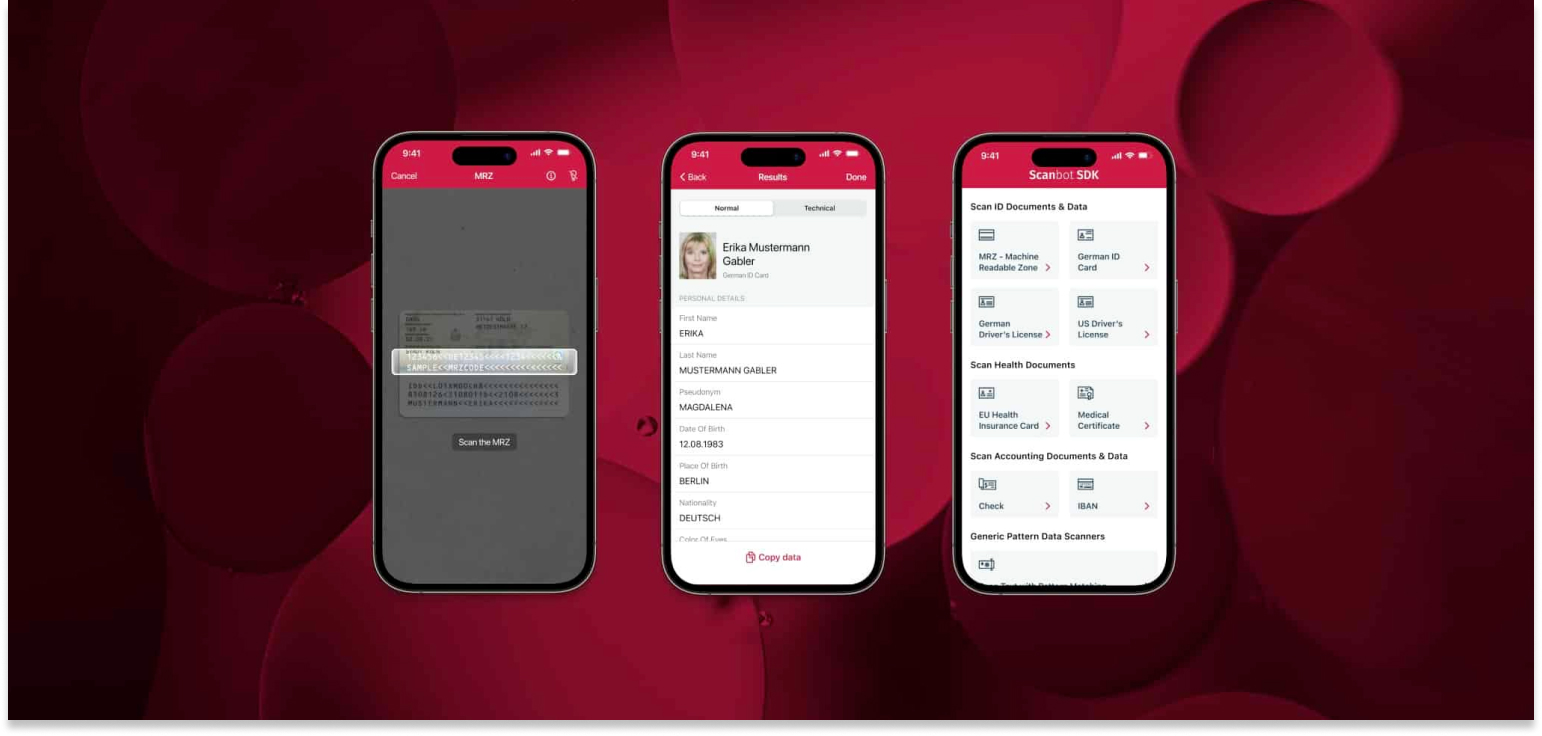

Check out our new Data Capture Demo App for iOS and Android

A new and revamped demo version of our Scanbot Data Capture SDK is now available for free on the App Store and Play Store.

Read post

4 min

Finance mobile app development: best practices to enhance your digital workflows

Let's dive into best practices that will elevate your finance workflows to a new standard.

Read post

4 min

5 interesting barcode use cases you might not know yet

Barcodes on bees, beer keg tracking, autonomous warehouse drones... What else can barcodes be used for? Find out in our blog post!

Read post

4 min

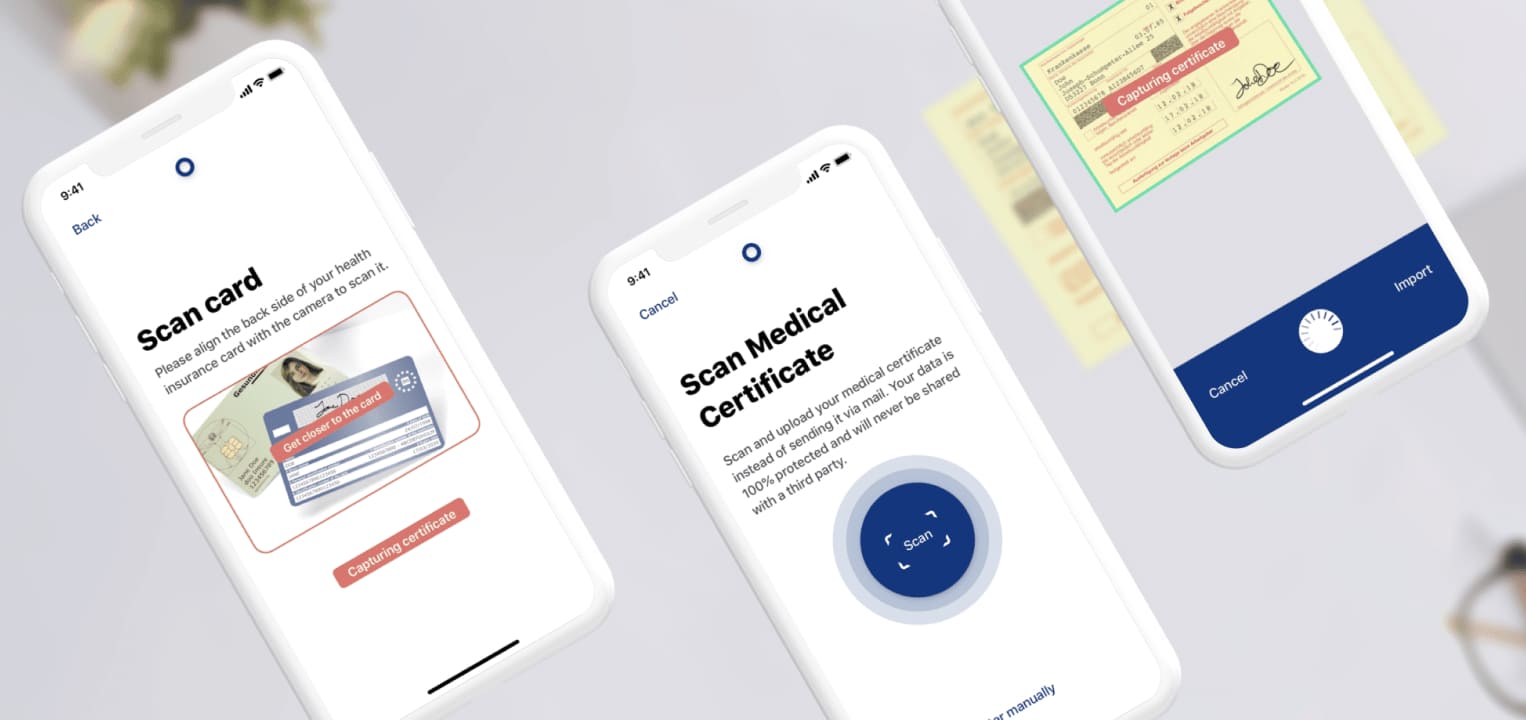

Insurance mobile app development: 3 factors for a high automated processing rate

Learn everything about the importance of tutorial screens, frictionless backend configuration, and helpful features, such as image filters or blur estimation, now.

Read post

5 min

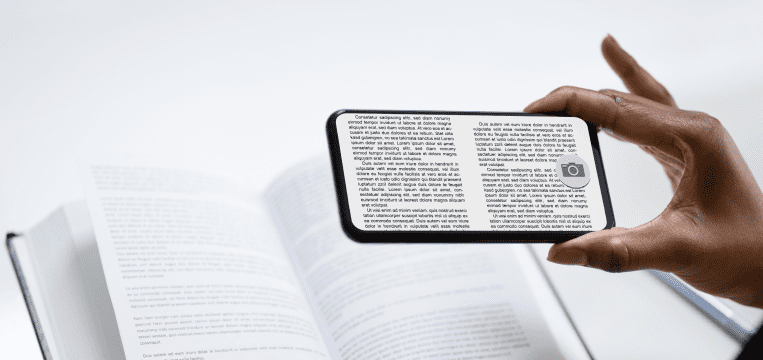

Document scanner apps: 7 features you shouldn’t miss out on

Just taking a photo of a paper document is not enough for automated processing. To find the right scanning solution, keep an eye out for the following features.

Read post

3 min

Smartphones as wireless barcode scanners – streamline your operations now

Are dedicated scanning devices still the best tool for all use cases? Or can cheaper, more flexible smartphones deliver the same performance? Let's now discover what modern technology in[...]

Read post

2 min

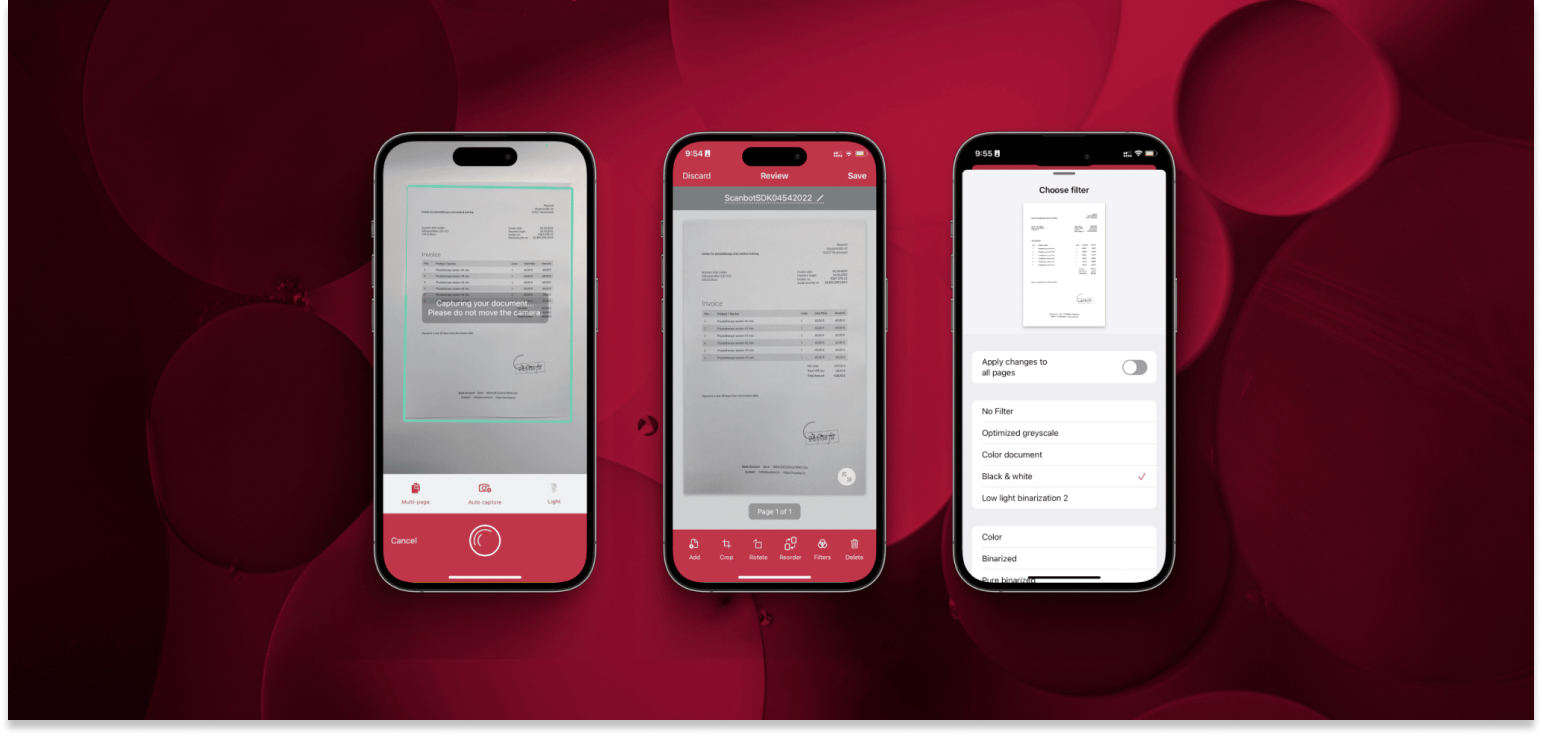

The new Document Scanner Demo App for iOS and Android has arrived

Our new demo app for scanning documents in just 2 seconds is now available on Google Play and the Apple App Store.

Read post

4 min

Assisted Reality wearables: How hands-free tablets empower frontline workers

Headsets with a built-in camera and an Android-based micro tablet employ sophisticated Assisted Reality software to display valuable information without obstructing the user’s view.

Read post

2 min

Meet our Barcode Scanner SDK for Windows

Our Barcode Scanning solution is now available for the Universal Windows Platform (UWP).

Read post

4 min

Create a reliable Track and Trace system with mobile Barcode Scanning

Find out how a mobile Barcode Scanner SDK can be the cornerstone of comprehensive Track and Trace systems.

Read post

5 min

5 things to look out for when deciding on an SDK

When it comes to SDKs, several factors can impact the success of your project. Here are five things you should consider when deciding which SDK to buy.

Read post

2 min

Introducing the new Barcode Scanner Demo App for iOS and Android

Our new demo app for scanning 1D and 2D barcodes is now available for iOS and Android.

Read post

4 min

Scan & Go – how smartphones as grocery scanners create a first-class in-store experience

Discover how mobile scanning can create a unique shopping experience that brings the new generation of digital shoppers into your stores.

Read post

4 min

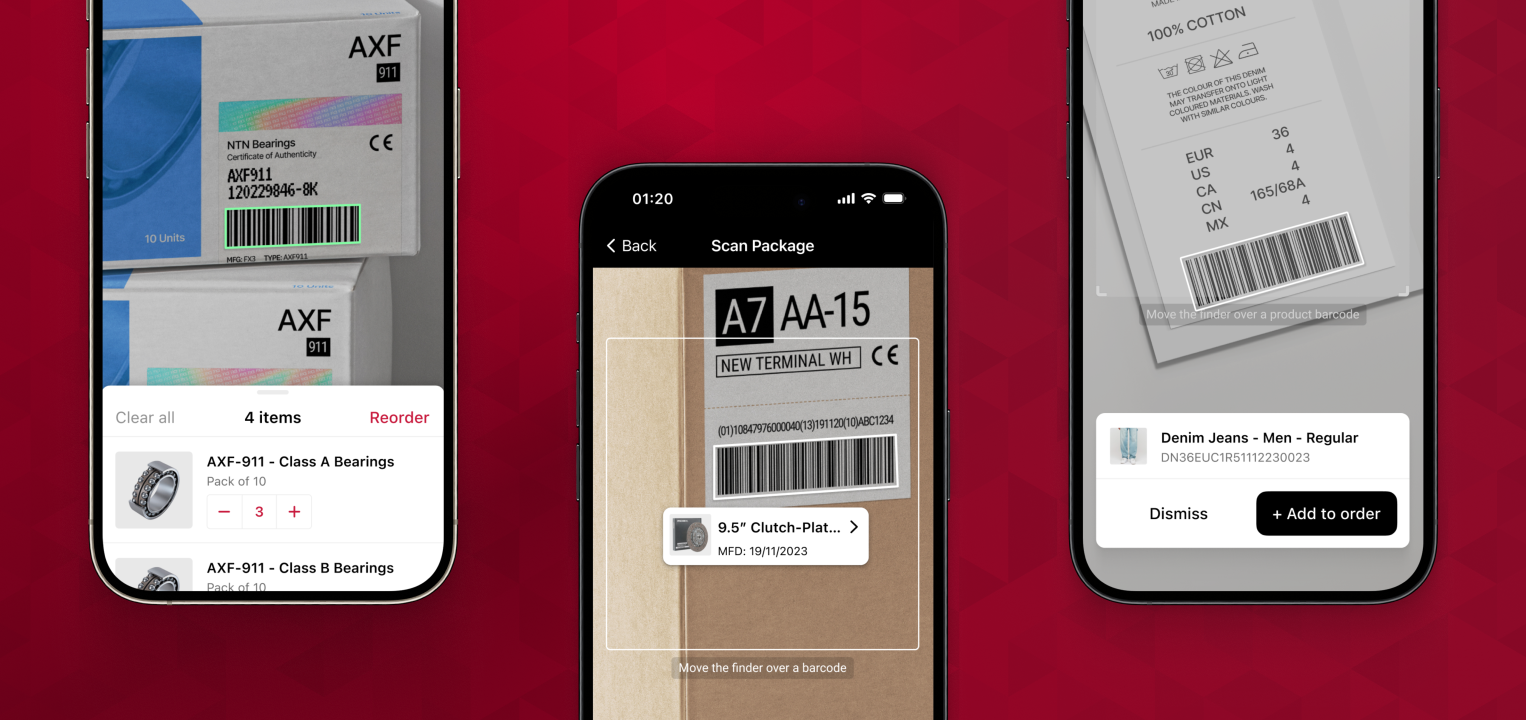

Navigating the Counterfeit Maze: Identifying Fake Industrial Products Using Barcodes

Mobile barcode scanners enable customers to check the authenticity of industrial parts within seconds. Learn more about how it works.

Read post

2 min

Dag Jessel joins Scanbot SDK as new CFO

Scanbot SDK welcomes Dag Jessel as Chief Financial Officer (CFO)! With more than 10 years of experience working as a Private Equity CFO / Managing Director for several SMEs,[...]

Read post

4 min

The benefits and drawbacks of Software-as-a-Service (SaaS)

The market for SaaS has been steadily growing for years, and for good reason. In this article, you will learn more about the advantages and disadvantages of the software-as-a-service[...]

Read post

2 min

It’s official: We’re now “Scanbot SDK GmbH” and “Scanbot SDK, Inc.”

We’re changing our companies’ legal names to better reflect our product offering and harmonize our brand globally.

Read post

6 min

Barcode scanner comparison – Scanbot SDK vs ML Kit vs ZXing

A comparison of barcode reader libraries and the Scanbot Barcode Scanner SDK regarding platforms, barcode types, integration, and support.

Read post

5 min

What is OCR software?

How does optical character recognition work? And what can we do to achieve better end results? This article will help you understand the underlying mechanics of OCR technology.

Read post

5 min

The role of OCR in automatic document processing

Using OCR, document processing can be largely automated. In this article, you will learn more about how OCR works and how to achieve the best results.

Read post

3 min

Driver’s licenses: Extract data from PDF417 using a barcode parser

Driver's licenses with PDF417 codes can be read by a barcode scanner with a built-in data parser to access a variety of useful information.

Read post

4 min

Machine learning in business processes explained simply

Let's dive into the details of the benefits of using machine learning for business use cases now.

Read post

3 min

Medical Certificate Scanner – Optimize document processing with automated data extraction

This article dives into the prospects of digitalizing medical certificates through cost-effective mobile SDKs, which enable the integration with your back office.

Read post

3 min

How to use a Check Scanner: Automate check clearing via remote deposit capture

Checks can be processed much faster by capturing a high-quality image and extracting data from its MICR code using a Check Scanner SDK.

Read post

5 min

How Deep Learning shaped Machine Learning Technology

Machine Learning (ML) seems everywhere these days, along with Artificial Intelligence (AI) and robotics. But ML and AI are not just buzzwords. Discover how Deep Learning shaped ML technology.

Read post

3 min

Medication scanners and other applications of barcode technology in healthcare

Implementing a mobile medication scanner solution and barcode technology improves workflows in the healthcare sector.

Read post

3 min

IBAN OCR – How to scan IBANs with any mobile device

Companies should now find digital, reliable alternatives to flawlessly digitize IBANs on paper documents. Learn more about mobile IBAN scanning and its benefits.

Read post

5 min

Manufacturing: How to implement an efficient barcode system

Here's how barcodes can help manufacturers optimize every part of their value chain to create flawless processes.

Read post

5 min

Barcode Scanner for retail stores – Optimize your ordering processes with mobile scanning solutions

In today’s greatly digitized world, companies are required to achieve the highest level of efficiency in all processes along the value chain to remain competitive.

Read post

4 min

Create efficient & cost-saving in-store operations with retail barcode scanning software

In this blog post, we are going to show you how the Scanbot Barcode Reader SDK contributes to the transformation of ordering processes and thus massively increases the time-[...]

Read post

5 min

Using smartphones as ID Scanners boosts your efficiency

What are the advantages of a smartphone for mobile data capture, and how can it be effortlessly turned into a scanner? Let's dive into those questions with our latest[...]

Read post

3 min

5 benefits of document digitization you need to know about in 2022

Digital document management is essential to optimizing your business processes in 2022. Let's dive into the 5 most significant benefits that digitizing your documents brings to your business.

Read post

5 min

How many types of barcode scanners are there?

What exactly distinguishes the different types of scanners? What are their technical features, where are they used, and what are the advantages and disadvantages of each? Let's now dive[...]

Read post

6 min

SDK & API – why those 2 tools usually go hand in hand

To deliver a flawless app experience both in-house and for end-users, it’s necessary to understand the differences between SDKs and APIs, how they work, and what role they play[...]

Read post

5 min

Electronic prescriptions software: Scan mobile & immediately redeem at online pharmacy

After a test phase beginning in July 2021, the electronic prescription will finally be introduced in January 2022. Online pharmacies must now create new ways for their customers to[...]

Read post

5 min

ID Scan – Capture personal information with your mobile app

When utilizing the right ID Scan features, profitable and productive workflows that are easy to use become a reality. Let’s take a journey through various use cases and modules[...]

Read post

4 min

BOPIS & BOSS – Two approaches to secure in-store shopping experiences

Due to COVID-19, safe ways that allow customers to purchase goods in-store without long waiting times became crucial. Let’s look at the two most common strategies that combine digital[...]

Read post

4 min

Pet insurance – how to submit vet bills within just a few seconds

Document scanning solutions enable fast transmission of veterinary bills in your mobile application or website and create frictionless, easy-to-use workflows that maintain short turnaround times and high customer satisfaction.[...]

Read post

5 min

Barcode scanning on smart devices – Why are smartphones the scanners of the future?

Especially around barcode scanning, low-budget smartphones can replace dedicated handheld scanners when combined with the right software solution. This is particularly advantageous for two-dimensional barcodes, as these can only[...]

Read post

3 min

Next-generation barcode reader

We are thrilled to announce the release of our next-generation Barcode Reader Version 3 (v3), taking the barcode scanning functionalities of the Scanbot Barcode Reader SDK to a whole[...]

Read post

4 min

SDK pricing: Annual fixed vs. volume-based pricing – Which solution is best for you?

In the SDK space, fixed-price and volume-based models are most commonly found. But which approach is the right one for your unique requirements? Learn more in our latest blog[...]

Read post

5 min

QR code use cases – Creative ways to streamline office life

When was the last time you have encountered a QR Code in your day-to-day life? Probably not too long ago, as this versatile 2D-barcode is one of the most[...]

Read post

5 min

Insurance app development – It’s time to build the right features

Increase customer satisfaction & accelerate your workflow by integrating a Scanner SDK with the highest privacy standards in your insurance app.

Read post

4 min

Logistics management software: The digital supply chain revolution

In many trucking businesses, all-in-one solutions for fleet management, driver security, and online marketplaces have become essential parts of everyday work life. Many of our customers are software vendors[...]

Read post

4 min

Digital document management – The link between stores and headquarters

When thinking about the retail industry and the benefits of a Scanner SDK, one usually considers barcodes as the essential use case. Of course, barcode scanners are vital for[...]

Read post

5 min

Industrial scanner – Cost-effective alternatives

Ever since its first revolution in 1800, the industrial sector has continually developed new approaches to make production, transportation, and communication between the divisions faster and more efficient. In[...]

Read post

5 min

Document data extraction – Capture information efficiently

Data extraction is one of our latest features. Check out the benefits of this new technology and find out how you and your company can profit from implementing this[...]

Read post

5 min

Government digitization – Automated data workflows for public administration

While the potential of government digitization is tremendous, heavy regulations can pose a threat towards digitization efforts. This article dives into the prospects of digital governments by explaining potential[...]

Read post

5 min

Insurance customer satisfaction – 3 keys to a valuable customer experience

Digitalization is a key factor in the insurance industry. Find out about the benefits of a digital workflow.

Read post

3 min

KYC verification through smartphones – Fully automated workflows

The Scanbot MRZ Scanner SDK allows you to onboard your users in the space of Know Your Customer (KYC) within seconds.

Read post

3 min

White label solution for mobile scanning – Customizable to your CD

About two months ago, we have implemented an important extension: A ready-to-use white label user interface, or UI for short. This allows your developers to integrate essential components of[...]

Read post

Show more

View all

Available on all common platforms

See all platformsReady to try the SDK inside your app?

Set up a test project and evaluate the SDK in your app for free!