What is input management?

Input management is the process of handling and organizing the various forms of information that are later fed into other business processes. Effective input management ensures that these backend systems accurately interpret and respond to user inputs, enabling seamless communication and interaction between humans and machines.

The key input management tasks include recognizing different types of input, processing them, and storing them for easy retrieval. This helps downstream processes to efficiently generate appropriate responses, ultimately enhancing the user experience and the effectiveness of the system.

What sectors is input management used in?

Input management plays an important role in a wide range of sectors, from technology over finance to manufacturing. Let’s now more closely examine how input management is used in the healthcare and insurance sector.

In healthcare, input management systems help in efficiently managing patient information, medical records, and billing details. They ensure accurate data entry, quick retrieval of patient history, and streamlined administrative processes.

Similarly, in the insurance industry, input management is essential for handling policy applications, claims processing, and customer inquiries. While these workflows are mostly automated, poor input quality often necessitates human intervention. The resulting errors and delays make for a poor customer experience.

How can you optimize your input management to save costs and increase efficiency?

While automated end-to-end document processing is on the rise, a significant portion of submissions still require manual processing. To maintain operational efficiency and secure customer loyalty, it’s essential to explore innovative solutions for fully automated digital document management.

Poorly digitized documents, like unedited smartphone photos without proper cropping, hinder automation. Document processing often hinges on successful text extraction through Optical Character Recognition (OCR) – which demands high-quality digitization.

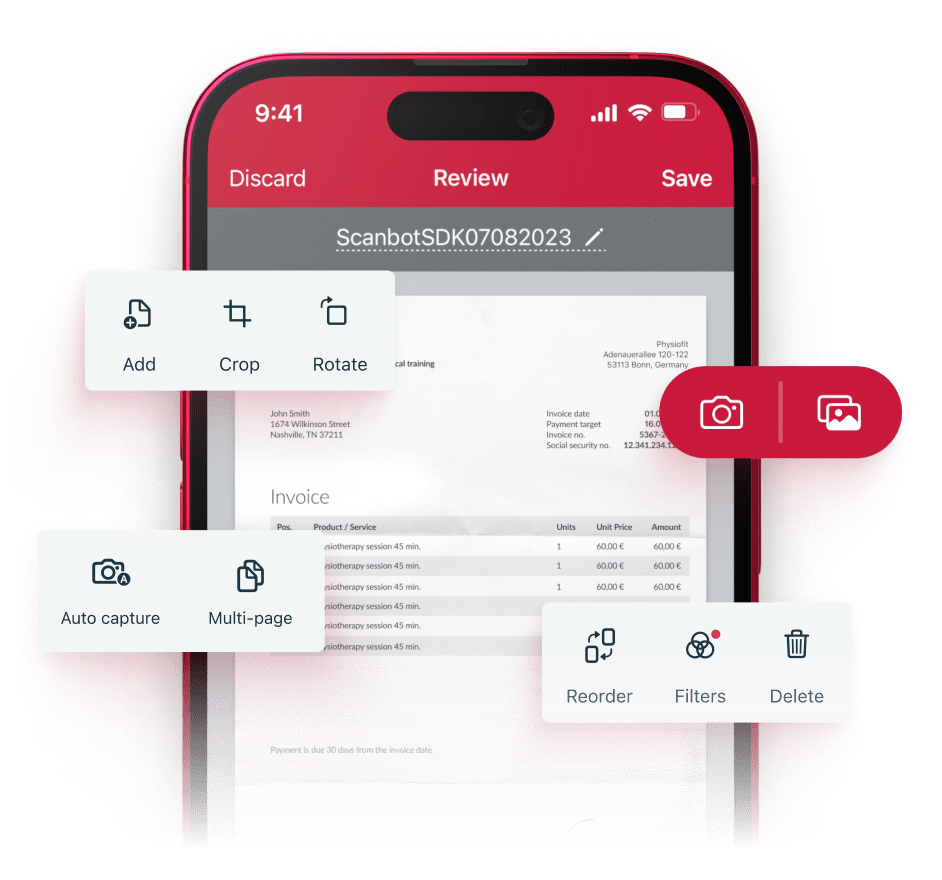

The Scanbot SDK reliably delivers ideal input for text recognition. Its user-friendly interface enables easy smartphone scanning and includes helpful features like automatic cropping and image quality estimation. Additionally, it supports several output formats, such as JPG, PDF, TIFF, and PNG, making it compatible with all kinds of backend systems.

Create high-quality document scans in seconds

Turn mobile devices into fast document scanners and generate high-quality scan results no matter the conditions.

Our Document Scanner SDK can be integrated into your mobile or web app in just a few hours!

Enhance document processing in the insurance industry

Input management is an essential part of many industries, insurance prominently among them. Let’s take a look at a typical process insurance companies use when it comes to processing data and different document types.

- The insured has a claim to make.

- They submit it via mail or fax.

- The hardcopy documents are sent to a third-party digitization provider.

- The provider creates high-quality document scans and sends them to the insurance.

- The documents are processed in the insurance’s backend solution.

- Documents that cannot be processed automatically must be handled manually.

Processing documents in this way is time-consuming and expensive. It is also dependent on third parties such as the postal service and other logistics providers. Poor-quality documents may be impossible to process altogether.

With the Scanbot SDK, insurers can replace this cumbersome process with efficient, seamless workflows. This benefits both the insurers and their insureds.

- The insured has a claim to make.

- They open their carrier’s app or online portal to upload the required documents.

- They create high-quality scans using the Scanbot SDK’s intuitive user interface.

- The scanned documents are transmitted to the insurer’s backend and processed.

The Scanbot Document Scanner SDK can revolutionize claims processing, saving time and money while providing a smooth user experience. Advanced features, among them blur detection, automatic scanning, and skew correction, significantly enhance the quality and efficiency of document capture and management. This speeds up claim settlements and ultimately improves customer satisfaction.

Scanbot SDK: your trusted partner for document digitization

The ability to convert physical documents into digital formats has become paramount for document processing. If your goal is to implement seamless input management and digitization workflows, the Scanbot Document Scanner SDK is an invaluable tool.

Our SDK offers a comprehensive solution that enables developers to rapidly integrate advanced scanning functionalities into mobile apps and websites. With its reliable automatic detection, document capture technology, and smart image optimization filters, the Scanbot SDK ensures that documents are captured with exceptional image quality and accuracy.

This speeds up the input process and minimizes error-prone manual data entry. With effortless digitization, businesses across sectors like healthcare and insurance can manage and process data more effectively. By improving efficiency and simplifying information retrieval, mobile document scanning reduces costs and enhances the customer experience.

We strive to be a trusted partner for those aiming to streamline input management and leverage the advantages of document digitization. As such, we have designed the Scanbot SDK and its output formats to work seamlessly with a variety of input management systems.

Are you interested in integrating the Scanbot SDK into your mobile app or website? Then feel free to contact our solution experts and try out our Document Scanning Demo App! We look forward to helping you find the best approach for your use case.