Disadvantages of paperwork for insurances & their clients

Whether you work in the insurance industry, or you’re an insurance customer, the chances are high that the thing that takes up most of your time is paperwork. This is bad for the environment and bad for processing times. Also, physical paperwork that’s in motion (either in the office or in the mail) is prone to damage and loss. Sometimes it is even leading to severe delays with claims processing or setting up new accounts.

What attracts insurance app users?

At this point, very few insurance companies have their own mobile app, and uptake by customers is low. Insurance is something that people don’t tend to think about unless they’re looking for a new provider or in case there’s a problem. Traditional insurance apps only have a 5% uptake rate.

However, that uptake rate is set to grow 4% in 2019. The main reason why people avoid installing their insurer’s app is that they can’t picture themselves getting much use out of it. Which consequences should insurance companies draw from these numbers? How can they add value for customers and employees alike?

The right features

The right features can make a real difference to your company, your customers and ultimately the whole healthcare system. Now that using high-quality smartphones has become more common, advanced features are more accessible to users of every age.

Which features can add value for users?

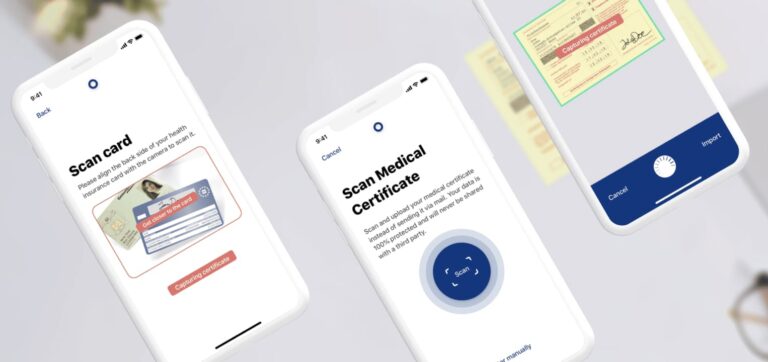

Automation and digitization of document processing

By including a secure scanner with data extraction and text recognition properties, insurers can simplify the slowest and least reliable parts of insurance purchase and claims handling procedures. Add dedicated scanning and data extraction for medical certificates and EHIC (European Health Insurance) cards to your health insurance mobile application.

This facility helps customers and claims handlers alike, giving instant access to vital documents and other claims evidence. Losing important paperwork in the post will belong to the past from now on.

Additionally, automation can reduce the cost of a claims journey by up to 30%. Making the right features available in a mobile app is a great way to automate document handling. A Medical Certificate Scanner, as well as an EHIC-scanner, is therefore essential for your mobile insurance app.

Scanbot offers a secure scanner that is able to recognize medical and EHIC certificates, extract data from government ID, and parse data from other documents. It makes document processing safe and straightforward.

Automation also makes it easy to produce and audit trail, with times, dates, and even locations built into every procedure.

Option to offer novel or flexible pricing structures

With the right app support, insurers can provide flexible policy pricing, where customers can pick and choose options to suit their budget. It’s also possible to offer pay-as-you-go for products like motor insurance, by combining an app with a black box telemetry device.

Improved customer experience

Live claims tracking and improved new claim procedures are easy to build into a mobile app. A simple way to give customers a better experience when dealing with the events leading to their claim. Included self-service tools can help customers to manage their accounts on the fly.

Develop additional features to add value for customers

Not all features need to be centered around claims. Additional features targeted at your customers’ related needs can boost app use and build customer loyalty. Why not help car insurance buyers work out running costs for their new car? Or support home buyers figure out what their utility bills might be?

Location services

With GPS, car insurance customers can pinpoint the location of an incident and call for recovery services. Claims for items like stolen bicycles and even professional indemnity insurance can also be pinpointed to within meters of the incident.

E-signature

If your jurisdiction allows it, adding digital signature capabilities can rapidly speed up the purchase and claims processes. Your customers can easily create images of their signatures and sign documents within seconds afterward.

Partner programs

By adding a portal to access discounts from related services, customers can be encouraged not only to keep using the app. They can also enjoy features and services that help them reduce their premiums and other associated outgoings. A health club tie-in could offer reduced healthcare insurance rates. Discounted access to museums and events could encourage travel insurance users to keep the app to hand whilst traveling.

Additionally, insurers can use their app as a portal to access other services as part of an ecosystem of various offers related to their type of insurance.

Insurance app development: Add value to your customers

Insurance companies and app developers should take advantage of improvements in technology to offer apps that add value, both in the event of a claim and in the customers’ everyday life. Modern smartphones all come with adequate cameras to add document scanners and automated claim photo handling. Today’s users are delighted to spend most of their time on their smartphones using different apps, as long as those include the right features.

If you want to add value to your insurance mobile app, don’t hesitate to contact one of our experts. Let’s talk!