In our survey State of Multichannel Retail 2023: Exploring U.S. Consumer Preferences and Expectations, we asked 1,000 American consumers 15 questions about their preferences regarding online and offline shopping, multichannel retail, and self-checkout technology.

The survey took place on April 6, 2023. Participants consisted of three age groups: Below the age of 25, between 25 and 44, and 45 and above. These groups roughly correspond to Generation Z, Millennials, and Generation X/Baby Boomers.

Key findings

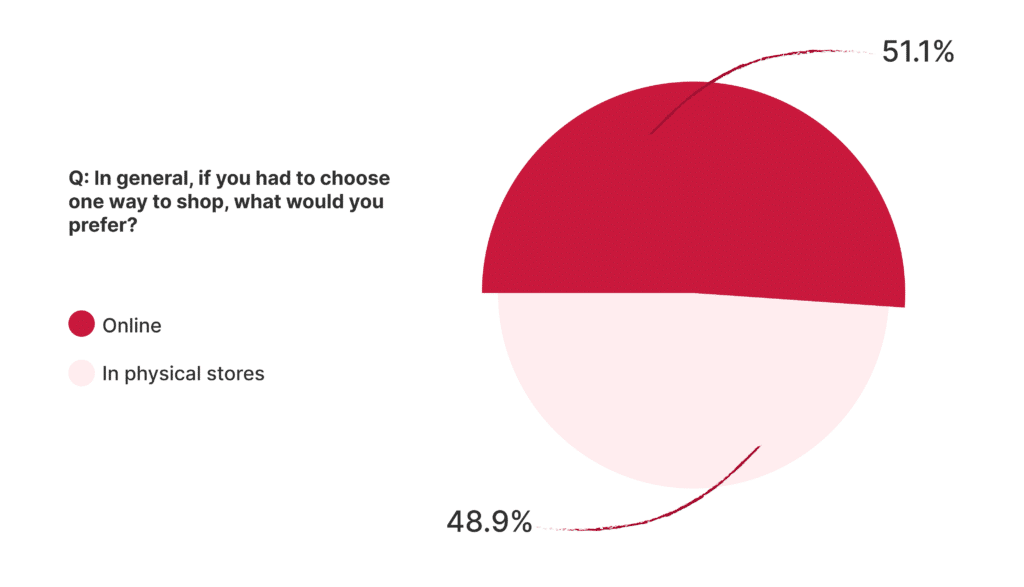

- 51.1% of respondents indicated that if they had to choose between buying their goods online or in a store, they would go for the online option.

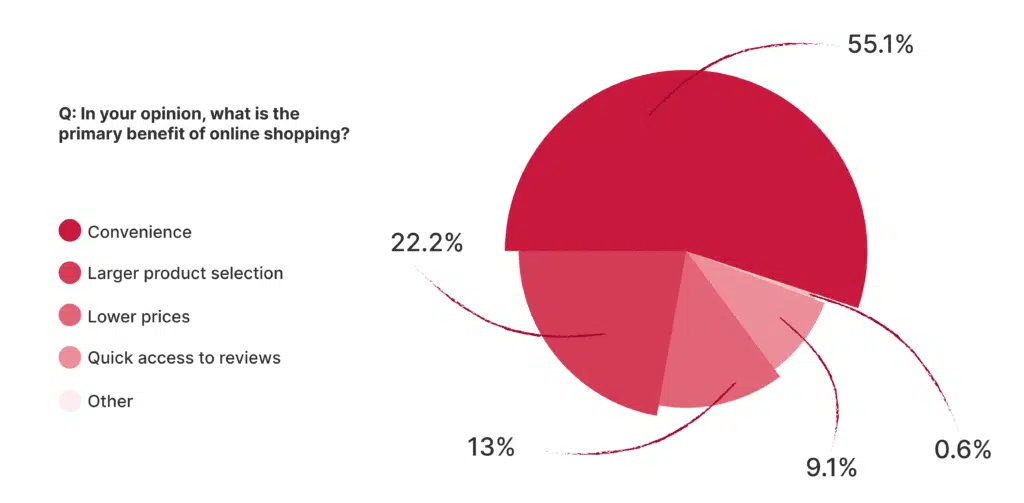

- A majority of respondents (55.1%) see convenience as the main benefit of buying goods online.

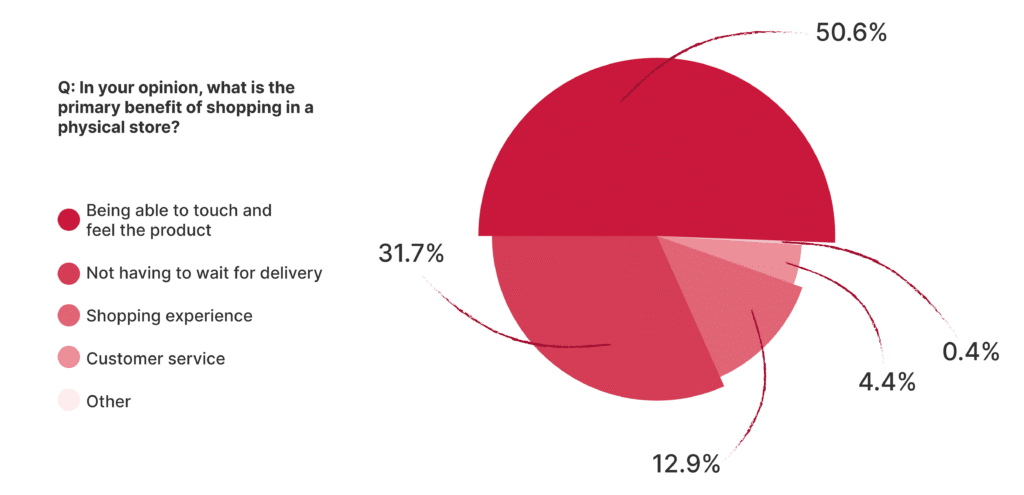

- For over half of consumers (50.6%), physically interacting with the product is the number one reason they prefer to buy certain things in brick-and-mortar stores.

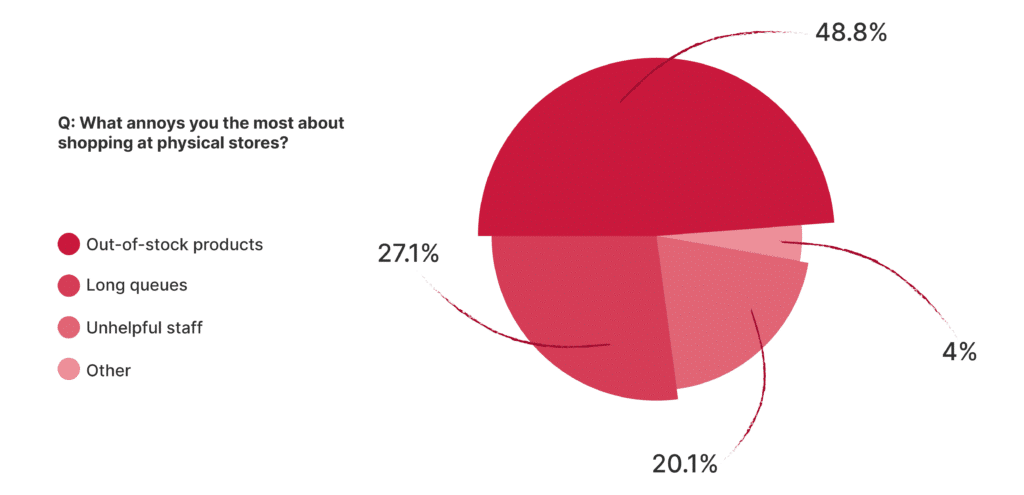

- Nearly half of all survey participants indicated that what annoys them most about buying goods in stores are out-of-stock products (48.8%).

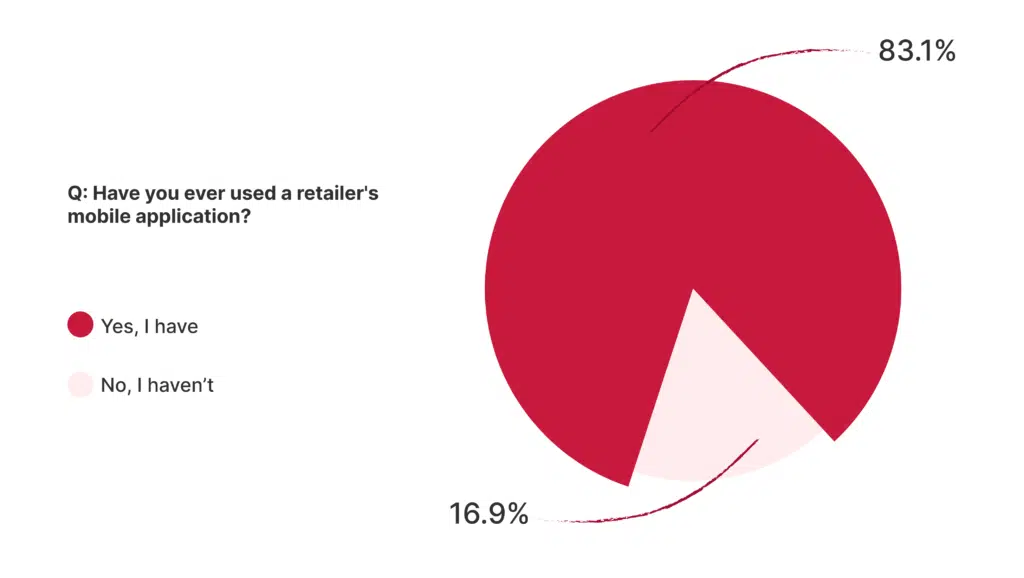

- The vast majority of survey participants has used a retailer’s mobile application at least once (83.1%).

- 82.4% of respondents have already used their smartphones for Scan & Go or would like to try it.

- Regarding the participant’s concerns about smartphone-based self-checkout, data privacy was the top issue (36.5%).

Some insights were surprising. For example, Millennial participants integrated technology into their shopping behavior to a slightly larger degree than respondents from Gen Z. Older participants were also much more likely to try out new self-checkout technology than expected.

But the most important takeaway is that online and offline shopping is not an either-or decision: Consumers prefer having several options. This means that retailers must offer a multichannel experience and integrate the benefits of both approaches to stay competitive.

Let us now take a closer look at the survey questions and the participants’ answers.

Comparing online with brick-and-mortar shopping

The internet has completely changed the way people buy products. And although the relationship between online and offline shopping is often depicted as a fierce competition, the reality looks a bit different: Online shops and brick-and-mortar stores each fulfill specific consumer needs, as the answers to our survey demonstrate.

Preferences for shopping online or in a physical store are divided

51.1% of respondents indicated that if they had to choose between buying their goods online or in a store, they would go for the online option. This shows that there is no clear winner in the online-offline race and that physical locations are still attracting customers.

But it also shows that retailers without an online shopping presence are missing out on a large customer segment. A multichannel approach is the best option to capture this hidden potential.

When looking at the age distribution, Millennials prefer online to offline shopping the most (59.92%), whereas Gen X and Baby Boomers gravitate towards brick-and-mortar stores (59.79%). Surprisingly, Gen Z shows a nearly even split, with physical stores slightly ahead (50.72%).

Online shopping is all about convenience

A majority of respondents (55.1%) see convenience as the main benefit of buying goods online. Being able to shop anywhere, anytime, seems to be a big draw.

The generally larger product selection of online shops is far less important (22.2%), and even lower prices are rarely the deciding factor (13%). The results are similar across all age groups.

The primary benefit of physical stores: Being able to touch and feel the product

However, convenience is not everything. There are some products that consumers want to inspect before purchasing. For over half of consumers (50.6%), physically interacting with the product is the number one reason they prefer to buy certain things in brick-and-mortar stores.

Being able to just buy and take the item home, rather than having to wait for delivery, is the big plus for another large group of respondents (31.7%). Once again, there was no significant difference between different age groups.

Both these factors, however, depend on the desired item actually being present in the store.

Stores should therefore take care not to frustrate customers by not having all options (like different clothing sizes) available. Finding a perfect set of pants and then not being able to try on a fitting pair might sour them on the in-store experience. An appealing product display also goes a long way towards making shoppers want to spend more time at the physical store.

Out-of-stock products are a customer’s nightmare

These findings were confirmed by our question about common annoyances of offline shopping. Nearly half of all survey participants indicated that what annoys them most about buying goods in stores are out-of-stock products (48.8%). Therefore, effective inventory and supply chain management is a must for any retail store.

Unsurprisingly, long queues are a major inconvenience as well, with 27.1% selecting it as their top annoyance. Alternative check-out methods have the potential to all but eliminate this nuisance for shoppers.

Of those who chose the “Other” option, many also highlighted the need to interact with other people and crowded stores.

The importance of a multichannel offering

The widespread adoption of smartphones during the last decade brought with it another increase in e-commerce. Many retailers have gone multichannel, some earlier than others. With digital natives an ever larger part of the population, an online presence is no longer a nice-to-have, but a bare necessity.

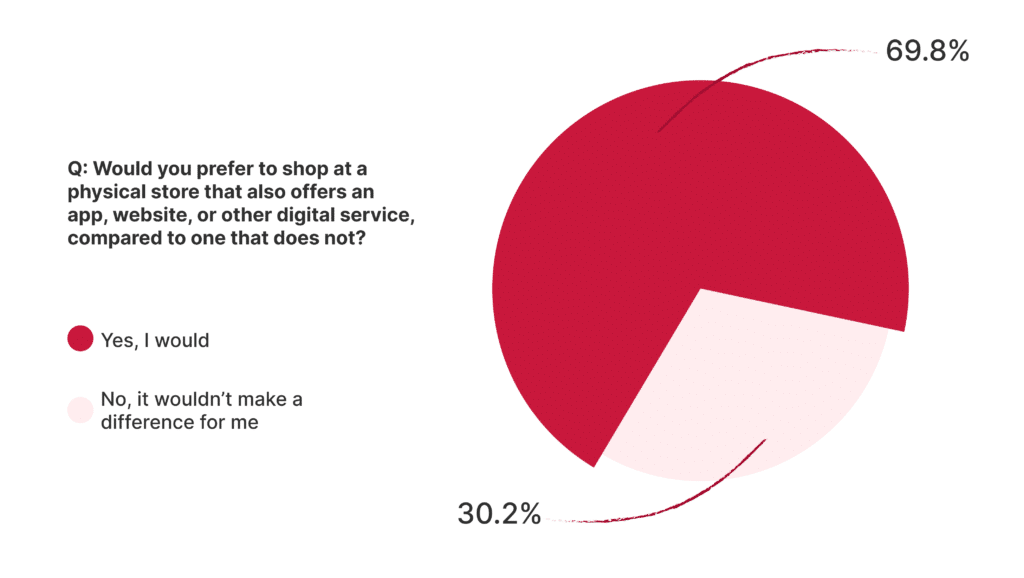

Customers prefer to shop at retailers with a digital presence

When asked if they preferred shopping at a physical store that also offers an app, website, or other digital service, more than two thirds of respondents answered yes (69.8%). This goes to show how crucial complementing a physical presence with a digital one is for retailers.

Once again, Millennials place the most importance on the digital aspects of their shopping experiences (75.05%). However, it also plays a major role for the other age groups.

Retailer’s mobile apps are well-established among customers

The vast majority of survey participants has used a retailer’s mobile application at least once (83.1%). This is only natural, considering the increase in e-commerce during the last decade. This number is even higher for Millennials (88.34%).

Retailers without a digital offering should therefore consider it a worthwhile investment, especially in light of customers preferring stores that have one.

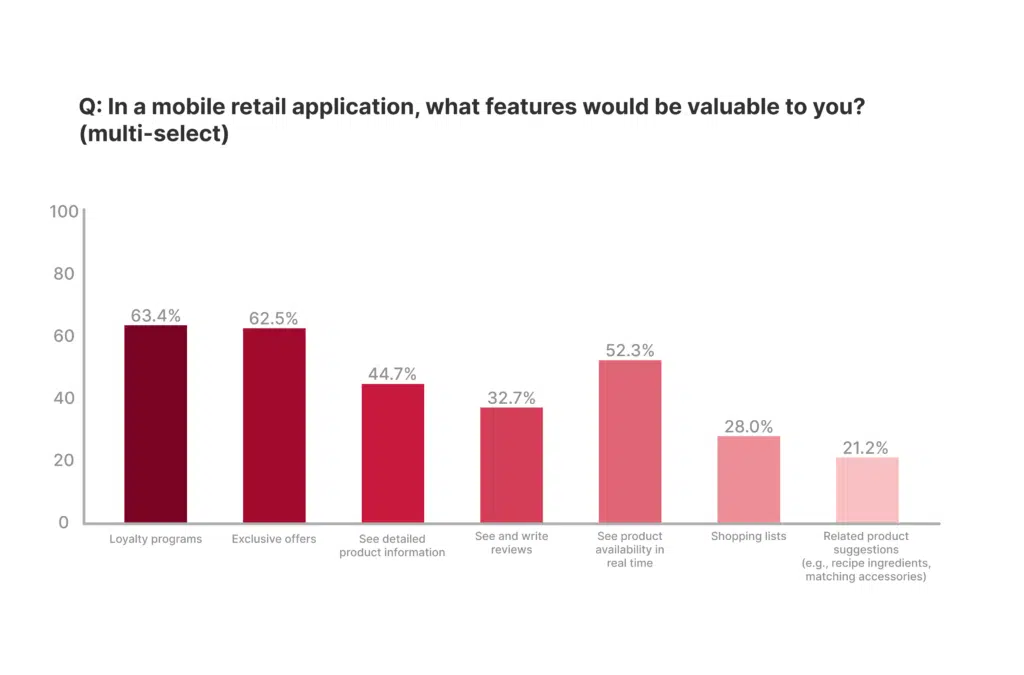

As for the app features they consider valuable, most survey participants chose loyalty programs (63.4%), closely followed by exclusive offers (62.5%).

The benefits for both customers and retailers are clear: Offers can be tailored to the customer’s shopping behavior by analyzing user data and every transaction is automatically rewarded with loyalty points – no physical card needed.

The ability to see a product’s availability in real time also plays a significant role (52.3%), which is consistent with the respondents’ opinions on out-of-stock products. Being able to check an item’s in-store availability in the app before going to the store is a major benefit. Another popular advantage of retail mobile apps is the ability to write and see product reviews.

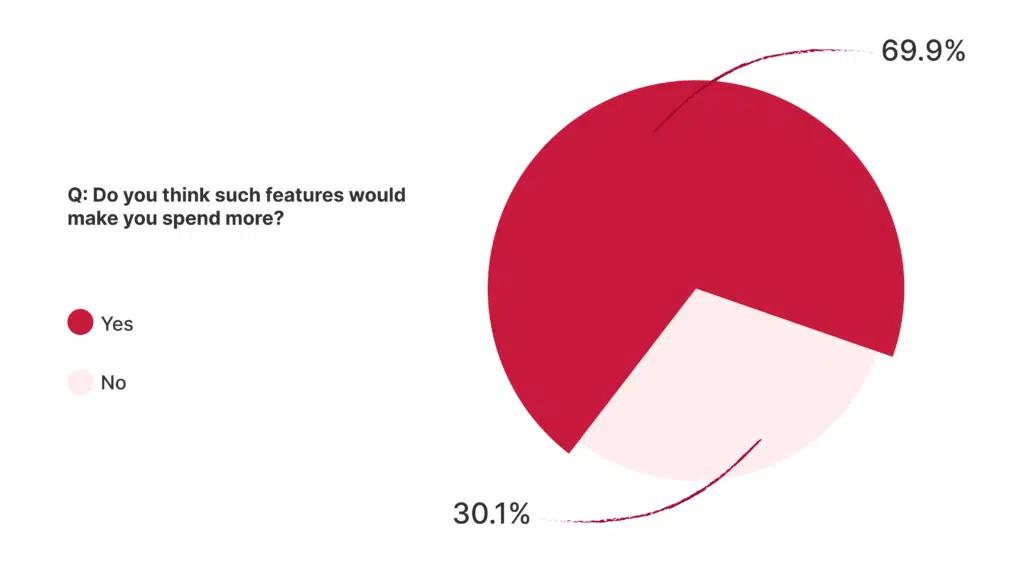

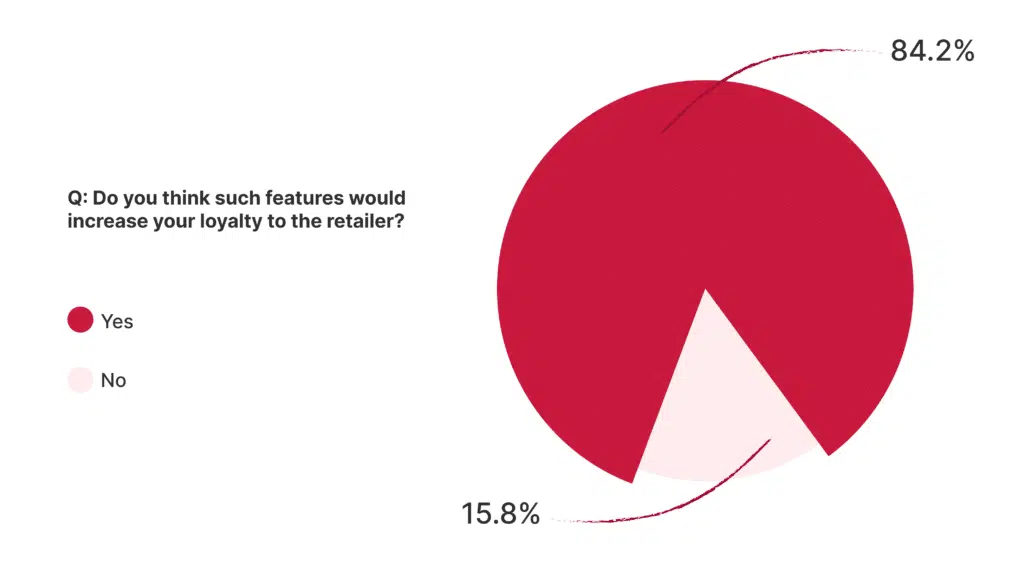

The majority of respondents think that having these features in an app would make them spend more money (69.9%), with even more of them indicating that this would increase their loyalty to the retailer (84.2%).

This strongly suggests that a useful app can increase shopping frequency and basket size, giving retailers that provide one a competitive edge.

The demand for Scan & Go (mobile self-checkout)

The survey results show that consumers value multichannel retail offerings such as mobile apps. But would they also be willing to use their smartphones for self-checkout? In Scan & Go, for instance, customers scan the barcodes on each item themselves, then pay for the whole basket directly in the app. This eliminates checkout queuing – and with it, a major source of shopper irritation.

Our survey participants seem very open to the idea.

Shoppers are interested in smartphone-based self-checkout

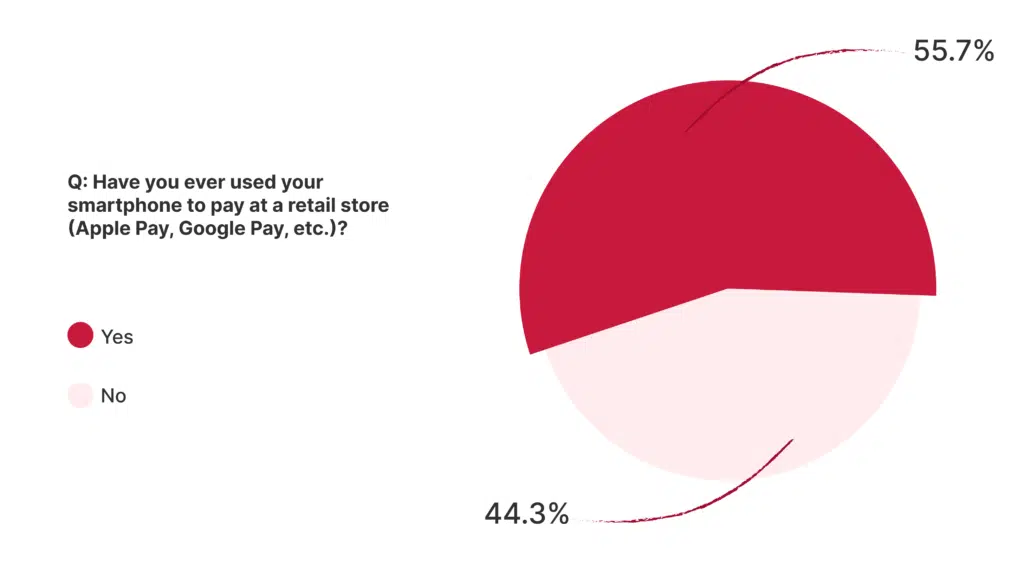

Paying by phone has barely been around for a decade, but it seems to have been adopted relatively well by the survey participants. Slightly more than half of them have used it at least once before to pay at a retail store (55.7%). Looking at Millennials, two thirds have done so (65.94%).

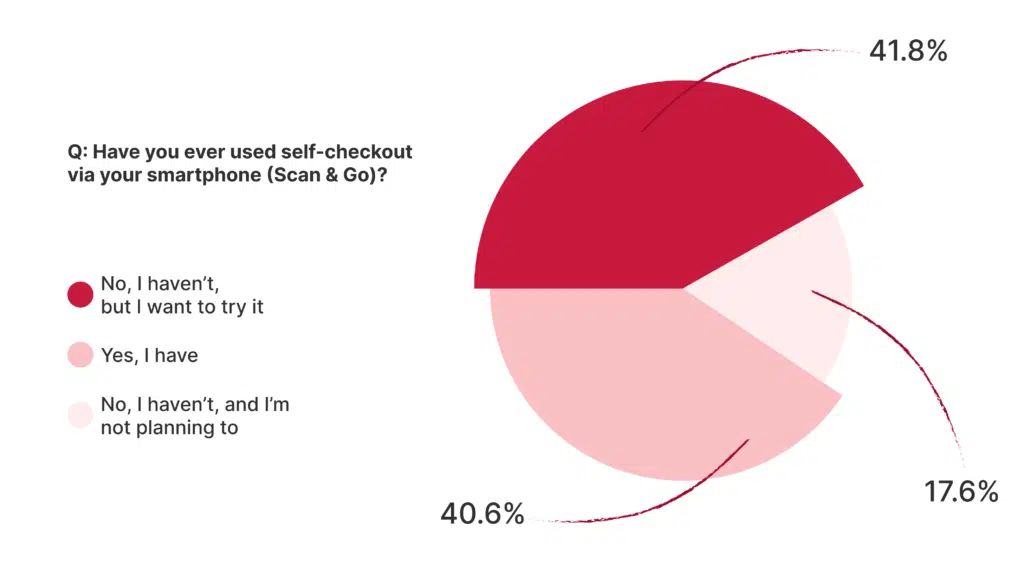

When it comes to self-checkout using a smartphone (Scan & Go), a large portion of respondents have already tried it (40.6%). Another 41.8% have not, but would like to.

Openness to Scan & Go extends across all age groups.

Even among Generation X and Baby Boomers, who have the least experience with this technology (31.1%), many are willing to give it a chance (40.48%). Only a small percentage of Millennials were uninterested in Scan & Go (10.84%), which matches the digital-first mindset suggested by their responses to other questions.

Customers are ready to skip the queue with Scan & Go

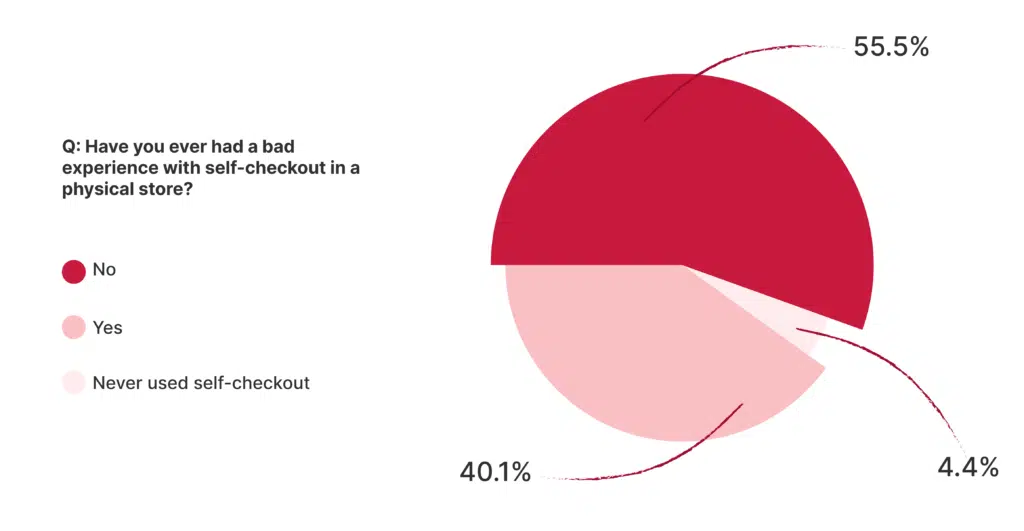

Slightly more than half of respondents never had a bad experience with self-checkout in stores (55.5%). Only a small fraction of people have never used it (4.4%).

While it is unfortunate that 40.1% have had at least one negative experience, this seemingly has not affected their willingness to give the technology another chance, as expressed in their interest in Scan & Go specifically. If anything, this means that retailers should instead invest in more advanced self-checkout technologies.

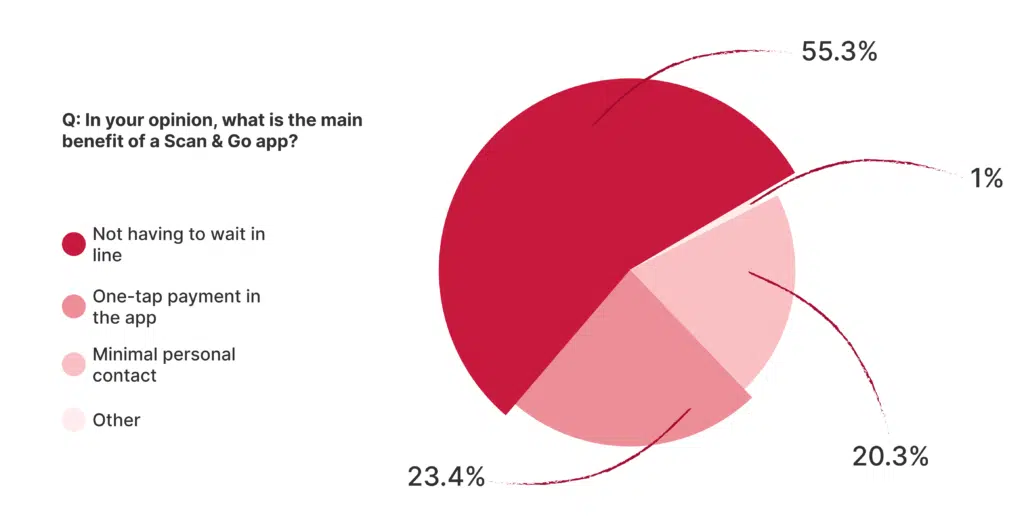

When asked about the main benefit of a Scan & Go app, more than half responded with not having to wait in line (55.3%). Minimizing personal contact (20.3%) and being able to pay quickly in the app (23.4%) rank lower, but are evidently key benefits for significant minorities.

Retailers must prioritize data privacy in their self-checkout apps

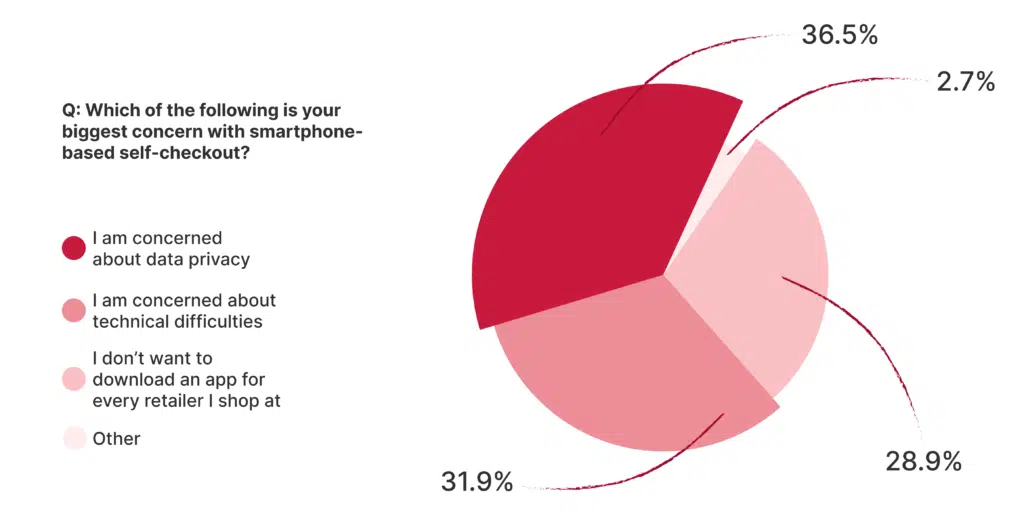

Regarding the participant’s concerns about smartphone-based self-checkout, data privacy was the top issue (36.5%). Therefore, retailers should make this their number one priority to avoid losing their customers’ trust. Technical difficulties were another major concern (31.9%), with some responses for the option “Other” going into more detail.

Being accused of stealing when they are actually using the self-checkout app worries some survey participants. Finally, a good portion of respondents are concerned about having to install an app for each store they shop at (28.9%). This particular issue can be addressed by providing web apps, which do not have to be installed. Due to recent advances, web apps can include barcode scanning, unlocking similar functionality as traditional apps.

Discussion

Through this survey, we have learned that consumers value both online and offline shopping, but for different reasons: While online shopping is all about convenience, physical stores offer them the advantage of inspecting and feeling the products and taking them home right away without having to wait for delivery.

Retailers that offer their customers both channels have a clear advantage over their competitors. The adoption rate of multichannel offerings is high, and many shoppers are interested in trying smartphone-based self-checkout technology. At the same time, retailers should prioritize data privacy so as to not lose their customers’ trust.

Millennials, in particular, show much untapped potential for retailers that look to expand their multichannel offering. The age group demonstrates a strong digital-first mindset and currently has the highest buying power.

Conclusion

The time is ripe for retailers to harness the advantages of both digital and physical stores by creating a multichannel offering for their customers. Investing in technology like smartphone-based self-checkout systems now will increase customer loyalty and gives retailers a competitive edge.