The retail industry is seeing a wave of exciting innovations, such as increased usage of augmented reality or new technologies for even smoother self-checkout in stores.

Our retail consumer survey from April 2023 found that retailers would profit from a multichannel offering for their customers – from combining the in-store and online shopping experience. This time, we wanted to see if there have been any relevant changes in how consumers feel about online and in-store shopping.

We will briefly introduce our new findings before comparing them to last year’s.

Methodology

Our retail consumer survey was conducted between August 12 and 27, 2024. We asked 1,516 Americans 15 questions about their shopping habits. The respondents are from all over the U.S. and vary in age. We divided them into the same three age groups as we did for our last survey, to allow us to make comparisons: those aged 25 or younger (hereafter Gen Z), those aged 26–45 (Millennials), and those aged 46 or older (Gen X and Baby Boomers).

Key findings

- If they had to decide between online and in-store shopping, our respondents were split exactly evenly (50.0%) between the two options.

- However, 75.26% of respondents prefer stores that offer both online and in-store shopping if they could choose.

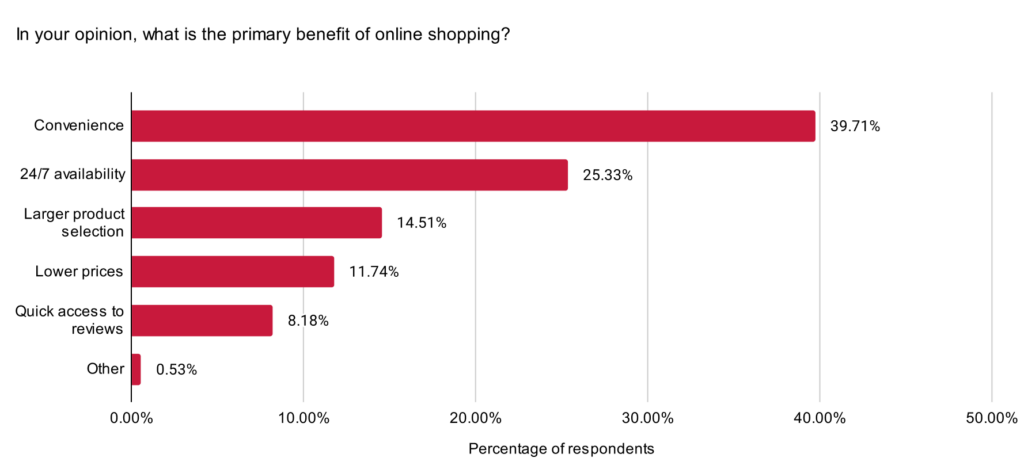

- 39.71% of respondents see convenience as the main benefit of buying goods online.

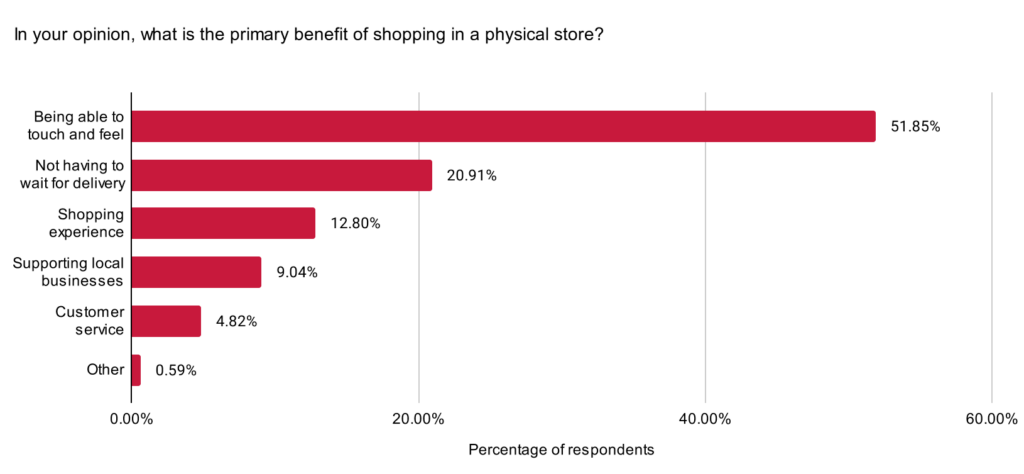

- The ability to experience a product is the main benefit of shopping in-store for 51.85%.

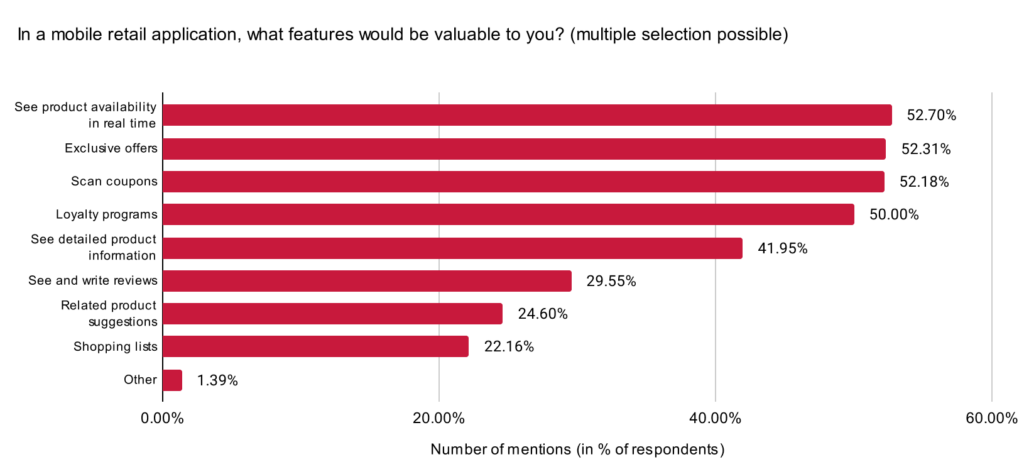

- Our respondents’ ideal retailer app would include features such as real-time product availability, exclusive offers, coupon scanning, and loyalty programs.

- 43.87% are annoyed by out-of-stock products while shopping in-store.

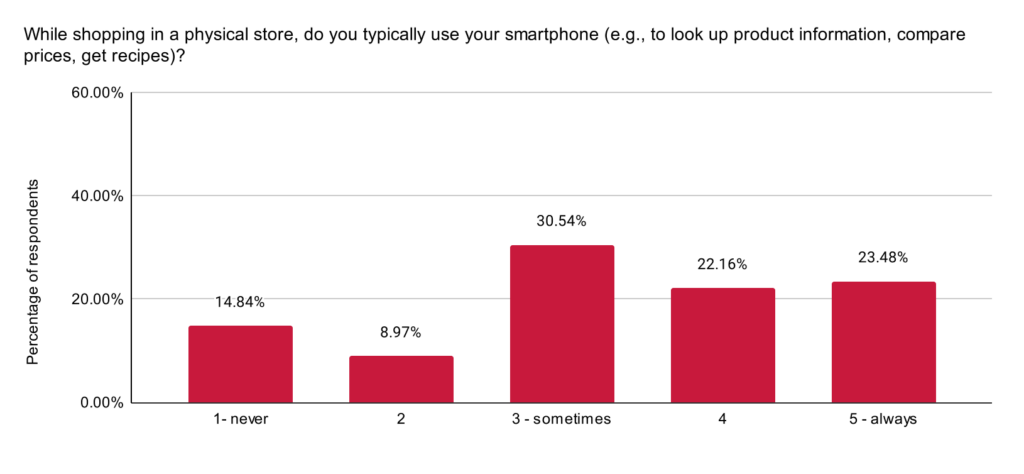

- The vast majority of respondents (85.15%) have used their phones at least a few times while shopping in-store, e.g., to look up product information, compare prices, or get recipes.

- 78.69% of our respondents report using a retailer’s mobile application.

- 74.28% of respondents have already used self-checkout via smartphone (Scan & Go) or would like to try it in the future.

Comparing online with brick-and-mortar stores

Preferences for shopping online or in a physical store are equally divided

Our respondents were tied when asked whether they would choose online shopping or shopping in physical stores if they had to decide. Precisely 50% of respondents chose either option.

A closer look at how different generations answered reveals a slightly different picture. With 52.43% and 57.63%, a majority of Gen Z and Millennial respondents would choose online shopping. In comparison, most Gen X and Baby Boomer respondents (56.68%) would still prefer shopping in physical stores.

We saw a slight decrease in Millennials compared to last year, of which 59.92% stated they would prefer online shopping, and a slight increase in Gen Z (49.28%) and Gen X / Baby Boomers (40.21%). This indicates that Gen Z and Gen X / Baby Boomers are increasingly confident using retail technologies.

Online shopping is all about convenience

The primary reason for two of three age groups preferring online shopping might be that well over a third of our respondents (39.71%) broadly see its convenience as a major benefit. Related to this is the 24/7 availability of products and services, which a quarter of our respondents specifically consider the main advantage of online shopping (25.33%). Both aspects indicate a need for a flexible shopping experience in a fast-paced society.

Compared to 2023, when more than half of our respondents (55.1%) named general convenience the main benefit, the ability to choose when to shop has gained importance.

Consumers like to touch and feel a product before buying it

One point that has not changed since our survey in 2023 is the key advantage that shopping in-store has over shopping online: Consumers (51.85%) can experience the product before committing to buying it. They also don’t have to wait for delivery, which 20.91% of our respondents see as the main advantage.

Consumers expect stores to be fully stocked

However, the delivery time advantage is of no use when customers go to retail stores only to find that their desired product is not in stock. 43.87% see precisely that as the main annoyance when shopping in-store. Long queues are the second most mentioned reason (29.68%) for frustrated shoppers. Both were the main annoyances of the respondents of our 2023 survey as well.

Others mention crowds and other shoppers as the top reason for an unpleasant experience. Physical obstacles, such as difficulties with parking, long travel time, and traffic, also pose challenges, especially for disabled customers.

Some respondents also complained about the inconvenience of in-store shopping generally, which further includes stressing factors like noise levels, decision fatigue, and uncomfortable dressing rooms.

Factors like these help explain why only 12.80% of our respondents value the actual shopping experience as the primary benefit of in-store shopping.

The importance of multichannel offering

Our last survey taught us that offering multichannel services is highly beneficial for retailers. It is no surprise that this time, with 75.26%, most respondents would prefer to shop at physical stores that also offer an app, website, or other digital service.

Customers prefer to shop at retailers with a digital presence

Let’s take a look at what the different age groups answered. Gen Z and Millennials – the digital natives – answered with 79.51% and 80.73%, respectively. Gen X and Baby Boomers surprised with 69.46% of respondents saying they would prefer retailers with some kind of digital offer. Even the supposedly less tech-savvy generations are convinced by the advantages of multi-channel shopping and appear willing to adapt to it.

Customers use their smartphones in retail stores all the time

In tune with the ubiquity of mobile devices, a vast majority of our respondents (85.15%) use their phones at least sometimes while shopping in-store to look up information, compare prices, or get recipes. Almost a quarter of our respondents (23.48%) even use them every time they go shopping.

Since so many consumers use their smartphones in the store anyway, retailers do well to offer a mobile retail app in which they combine several features.

Retailer’s mobile apps are well-established among customers

This idea seems to appeal to our respondents: 78.69% answered that they had used a retailer’s mobile app before.

The number for Gen Z and Millennials is even higher, at 84.03% and 88.55%. Gen X and Baby Boomers don’t fall too far behind with 69.18%.

When asked which features would be valuable to them in a mobile app, 52.70% answered that they would like to see product availability in real-time, closely followed by exclusive offers (52.31%), the ability to scan coupons with the app (52.18%) and loyalty programs (50.00%). Some respondents also suggested that a feature that showed a product’s physical location in-store would be helpful and that they would like to use the app for Scan & Go.

This indicates that most respondents would like to use a retail mobile app for two main reasons: convenience and saving money.

84.89% of respondents say their loyalty to the retailer would increase with these features, and two thirds (65.63%) would spend more money because of them. This shows that investing in a mobile app would bring several benefits.

Other benefits for the retailer are that they can tailor offers to customers’ shopping preferences by analyzing user data and that every transaction is rewarded with loyalty points automatically.

In light of the above findings, especially since most respondents have already used mobile apps, retailers can consider them a worthwhile investment.

The demand for Scan & Go (mobile self-checkout)

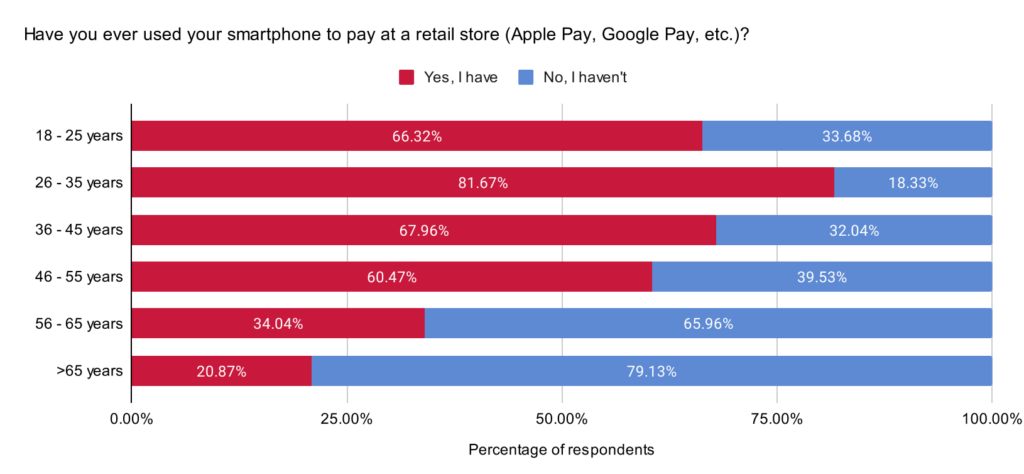

Over half of our respondents (55.61%) have already used their smartphone to pay at a retail store. Taking a closer look, we see that this number is distributed differently in the three age groups. More specifically, Gen Z (66.32%) and Millennials (74.24%) are open to the idea, as opposed to most Gen X and Baby Boomers (just 37.36% adoption).

As mentioned before, our respondents also generally use their smartphones in retail stores for different reasons. When explicitly asked, an impressive 90.83% of them have used their smartphone to look up detailed product information or want to try doing so.

As this survey’s findings generally support last year’s – that consumers highly value a multichannel retail offering – retailers might want to take these findings into consideration and offer self-checkout via smartphones. Not only would that save customers cumbersome queuing, but it would also open another opportunity for promoting a retail mobile app.

Customers are still ready to skip the queue with Scan & Go

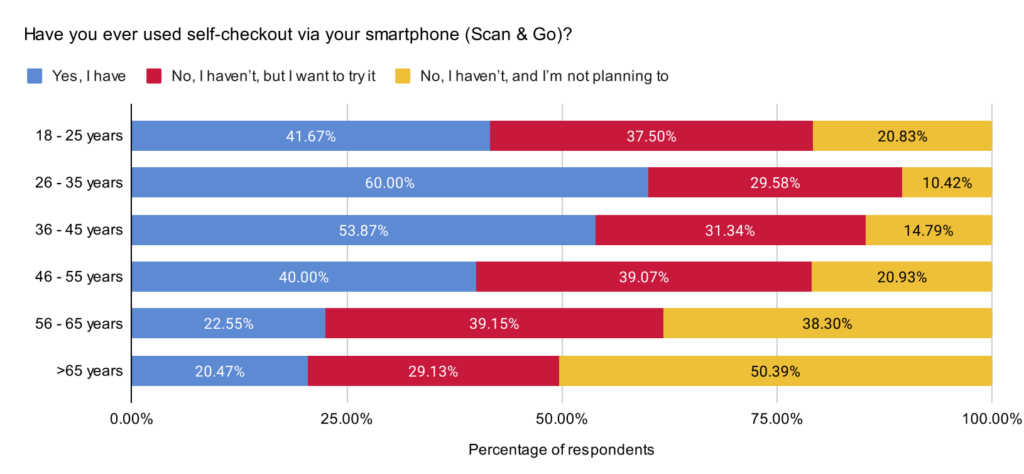

74.28% of respondents are ready to take that next step and have already used or would like to try self-checkout (Scan & Go). Of the respondents who have actually used it, Millennials are the biggest group (56.68%), followed by Gen Z (41.67%). Baby Boomers and Gen X fall somewhat behind with 27.13%.

These numbers generally match the results of our 2023 survey.

Over half of respondents (55.87%) appreciate that they don’t have to wait in line when using Scan & Go, which is almost the same amount of respondents from our 2023 survey (55.3%). Nearly a quarter (23.09%) are interested in the contactless one-tap payment method provided by Scan & Go apps.

Generally, respondents favor features and functionalities that save them time.

Consumers don’t want their phones cluttered with apps

However, our respondents’ biggest concern (35.16%) about using smartphone-based self-checkout is downloading an extra app for every retailer they frequent. Smartphones quickly become cluttered because of just how often there is an app for that.

Yet many functionalities that improve the customer experience and their loyalty do not actually require an app. They can be integrated into web apps that do not have to be installed, especially existing online stores.

Just imagine a multichannel experience where a customer simply scans a cumbersome product like furniture, which is put straight into their online shopping basket and will then automatically be delivered to their home.

While doing so, retailers must ensure that their customers’ data privacy is protected, as data privacy is the second most mentioned concern (34.43%).

Discussion

Our survey shows that opinions haven’t significantly changed since the last time we asked retailers about their preferences for online or offline shopping. Both ways still have strong advantages, and multichannel offerings seem to be the common ground retailers must find.

All in all, Millennials still seem to be the age group most ready to adopt new technologies, closely followed by Gen Z. Both groups demonstrate a strong digital-first mindset and will shape the future of retail with their demands.

Our respondents’ answers indicate that saving time and money while shopping is essential to them. With inflation still running high, consumers’ priorities are clear.

An innovative retailer mobile app with solid features such as barcode scanning could help them skip queues and save time and money with loyalty programs, Scan & Go, looking up product availability before entering the store, and more.

Listening to consumers is worth the time, as the findings will help increase customer loyalty and revenue in return.

Conclusion

This survey supports the findings of our 2023 retail consumer survey. Combining online and offline elements in a multichannel consumer experience will give retailers a competitive advantage and will help foster loyalty in the consumers of tomorrow. Retailers should act now to get ahead of the competition.