Insurance agents advise individuals and businesses on insurance options and act as intermediaries between them and the insurers. Some insurance companies offer their agents a mobile app, streamlining tasks such as managing customer data, generating quotes, and processing claims.

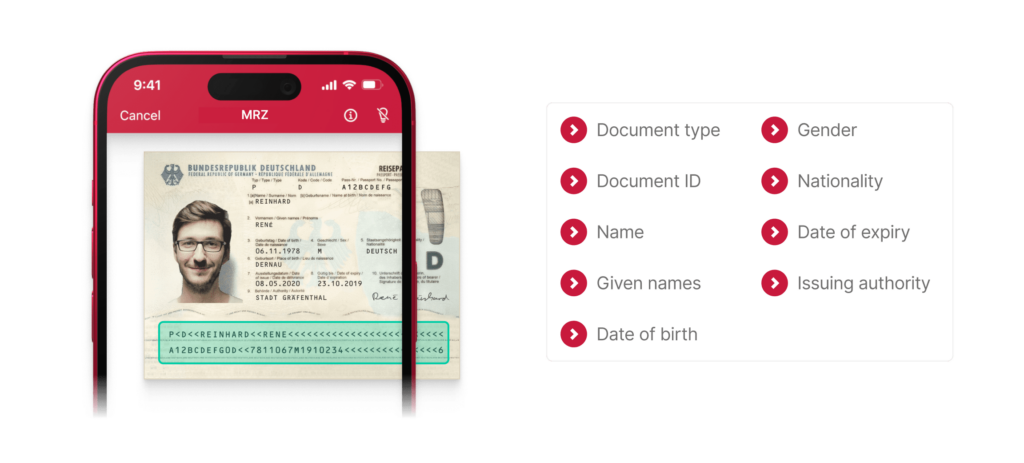

Being able to confirm a customer’s identity quickly benefits insurance agents immensely, which is why having a powerful ID document scanner is so important.

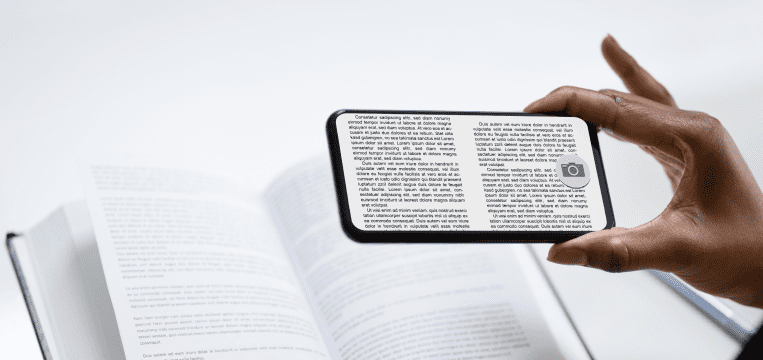

Scan and upload documents from anywhere

The ability to scan ID cards, passports, and European Health Insurance Cards (EHICs) directly from a mobile device helps insurance agents do their job more efficiently and flexibly. The benefits are better customer service, lower costs – and better security.

To begin with, mobile scanning in an insurance agent app speeds up customer-facing workflows, such as registration and onboarding, claims processing, and policy renewals. Apart from saving time, eliminating manual data entry also reduces costs.

With improved service, agents can build better client relationships, which increases retention and ultimately sales.

Security is another vital aspect: A mobile scanning app with built-in encryption and secure data transmission lets agents safely store and transmit confidential customer information. Automatic data extraction from documents should happen on the device, not on a third-party server, since transmitting sensitive information via an internet connection runs the risk of it being intercepted by unauthorized parties.

Eliminating manual data entry with OCR capture

High-quality data extraction of ID cards, passports, and EHICs go a long way in helping insurance agents with their work, since typing in data manually is tedious and error-prone.

Optical character recognition (OCR) technology helps agents automate this task, prevent mistakes, and improve efficiency.

With OCR, agents can extract information like a customer’s name, date of birth, and address as key-value pairs from ID cards and other ID documents and so speed up registration. This not only makes their job easier, but also saves the customers valuable time: Names and addresses, especially, are easy to get wrong when entered manually. Yet correcting this kind of mistake is often very cumbersome – and highly frustrating for clients.

OCR also makes it easy to search for and compile information.

Integrating ID scanning and OCR with an SDK

The easiest and fastest way to add mobile scanning functionalities to your insurance agent app is to use a software development kit (SDK).

An SDK comprises a set of tools, documentation, and resources that developers can use to integrate specific software components into existing applications. An SDK usually comes with a library of pre-built code modules, as well as sample code, tutorials, and technical support by its developers.

Since it has already been developed, tested, and refined by a team of experts, integrating an SDK instead of developing a solution in-house saves you time and resources. Additionally, SDKs receive regular updates and maintenance, so you always have access to the latest and most advanced document scanning technology available.

Our Data Capture SDK is fast, accurate, and operates entirely offline, never connecting to any third-party servers. This makes it a robust and secure tool for mobile data extraction. Its sleek and easy-to-use interface ensures that any user can automatically scan and extract data from documents – without manual errors.

Our software development kits are well-documented to ensure rapid integration, making them the perfect choice for time-critical projects. You can depend on our developer support for any questions and issues.

If you want to try out our SDKs, we offer a free trial license without any upfront paperwork.

Convinced that the Scanbot SDK is the right choice for your use case? You can count on us for reliable results and a sophisticated user experience. Don’t hesitate to get in touch with our solution experts so that we can find the best approach for your individual use case.