Check processing is a time-consuming and error-prone task for banks, financial institutions, and businesses. Check scanner software can help automate this process, saving them time and money.

Though many financial transactions are now digital, paper checks still play a significant role in payments. A study by the U.S. Federal Reserve found that in 2021, 12 billion checks were written in the United States alone.

The traditional way of redeeming and depositing a check seems anachronistic today: The payee mails or personally brings it to their bank branch, where a clerk then handles it manually. All this is not only time-consuming and requires physical effort from your clients and employees, it is also prone to error – and fraud.

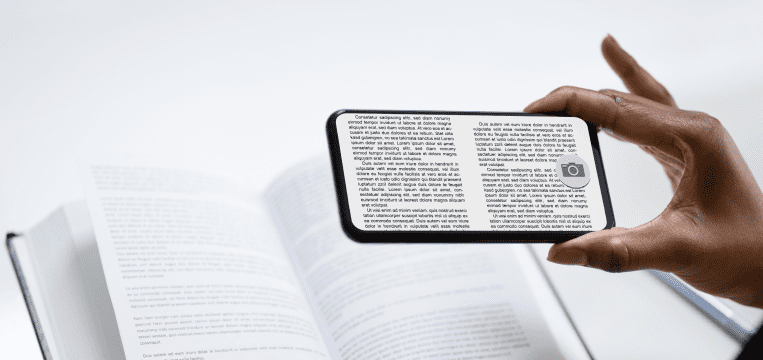

Easy and fast check truncation with a mobile check scanner

The modern, efficient solution is check truncation. With this method, customers still get to use their trusted paper checks, but check processing works dramatically faster. Bank customers simply scan their checks and upload them directly for automatic processing. All your clients need is the online banking app on their mobile device.

Businesses with a large volume of incoming check payments, in particular, profit from check truncation. Instead of physically moving every paper check to a financial institution, staff simply scan and upload the checks wherever they are. Rather than spend time on check processing, they can work on more important tasks.

Individuals who depend on timely check clearance also profit from the speedy process. The ability to deposit checks from home spares them time and effort and makes check processing more accessible.

A Check Scanner SDK is perfect for this purpose, enabling businesses to rapidly integrate a check scanner into any mobile application. Once launched, it uses the device’s camera to take a picture of the customer’s check and extracts the machine-readable MICR code (originally for magnetic ink character recognition). This standardized code contains information needed for fast remittance processing:

- Routing number

- Account number

- Check number

The SDK outputs this information in the form of key-value pairs, which ensures easy processing in the backend. Apart from the MICR data, the software provides a high-quality digital image of the check, which further simplifies processing.

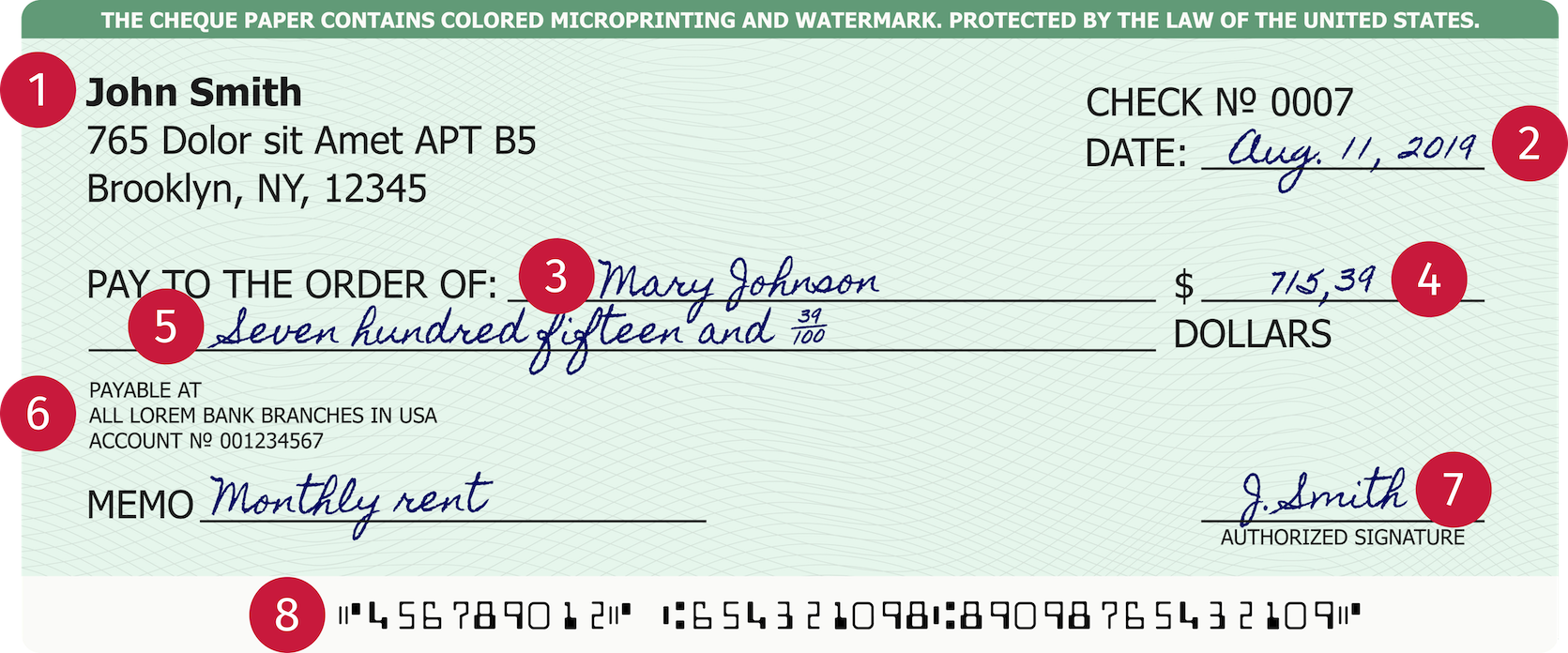

Identifying information on a check

Check layouts vary from country to country – and even from bank to bank. This makes automatic processing more challenging. However, checks typically contain the following information:

- Name of the person writing the check (drawer)

- Date from which the check can be cashed

- Name of the person receiving the check (payee)

- Amount the payee will receive, written in digits (courtesy amount)

- Amount the payee will receive, written in words (legal amount)

- Name and address of the drawer’s bank (drawee)

- Signature of the drawer

- MICR code

When making a check payment, the drawer instructs their drawee to pay the specified amount of money to the payee when the latter redeems the check. The money value is written down twice to create redundancy and thus mitigate human error

Scanning the check and automatically extracting the MICR code with a mobile device saves enormous amounts of time and effort. It also prevents mistakes – long sequences of digits are particularly prone to human error when recorded manually.

MICR reader and document scanning software

Scanbot SDK’s Check Scanner SDK allows your customers to scan checks along with the corresponding MICR codes and upload both the image and the data to your backend. All they need for this is a mobile device with your online banking app installed.

The SDK supports international check formats and comes with intuitive user guidance, as well as custom filters to optimize the raw check image for later processing. As the module operates entirely offline, it never sends any data to our servers or those of a third party. It therefore also complies with both the GDPR and the CCPA and is ideal for handling sensitive data.

The Scanbot SDK can be integrated into any iOS and Android app within a single business day. Our developers will support you every step of the way and clear any obstacles your team may encounter. The pricing model is simple: unlimited scanning for a flat annual fee, regardless of the number of scans, users, or devices.

FAQ

Can Scanbot SDK process checks with different layouts and formats?

Yes, Scanbot SDK is designed to handle checks with various layouts and formats. It can adapt to different check designs, ensuring accurate extraction of critical information like account numbers, routing numbers, and amounts, even with customized layouts.

What security measures are in place to protect check data when using Scanbot SDK?

Scanbot SDK uses on-device processing and operates entirely offline. It ensures compliance with financial data security standards, safeguarding sensitive information from unauthorized access during the scanning and processing stages.

Can customers use Scanbot SDK to scan checks from remote locations?

Yes, Scanbot SDK allows customers to scan checks remotely using their mobile devices. With its advanced image processing technology, checks can be scanned anywhere with a camera, making it ideal for remote check deposits or mobile banking applications.