In the United States, credit cards are the main payment method used in everyday transactions, with 82% of adults having at least one credit card in 2022. For businesses looking to simplify the customer experience, streamlining card payments is a smart goal. In a world where convenience is key, credit card scanning can make the difference between conversion and failure.

In this article, we dive into the world of credit card scanners. What are they? Why and where are they used? And what’s important to consider when choosing one for your business?

What is a credit card scanner?

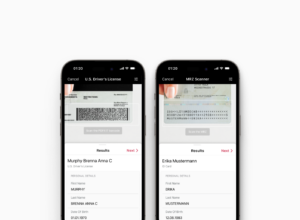

A credit card scanner is designed to extract information from credit and debit cards, especially cardholder names, card numbers, expiration dates, and CVV codes. There are two big types of credit card scanners: hardware devices and software solutions.

Hardware credit card readers decode the data from magnetic stripes or embedded microchips, whereas credit card scanning SDKs use optical character recognition (OCR) and machine learning to extract data from the card. With an SDK, credit card scanning can be easily integrated into mobile apps.

Most hardware credit card scanners are less flexible. They are usually tied to a specific point-of-sale (POS) system or a computer. It’s this host device that then connects to the network to process transactions.

Credit card scanning in selected sectors

According to Statista, e-commerce sales are expected to surpass $6.3 trillion globally, with nearly a third of all transactions already paid by credit or debit card. As online shopping continues to grow, businesses must ensure that their payment systems are both seamless and secure to keep their customers happy.

Credit card scanning for mobile apps contributes to a smoother checkout process, improving the customer experience and ultimately driving conversions.

In the retail industry, omnichannel is the new norm. Retailers are merging online and offline shopping experiences, enabling customers to purchase products online and pick them up in-store. At the same time, self-checkout systems and mobile POS solutions are gaining popularity. Online and offline payment methods thus meet. Here too, credit card scanning simplifies the checkout process, reducing waiting times and enhancing the overall shopping experience.

The banking and finance industry, meanwhile, uses credit card scanning to reduce fraud. By ensuring that the physical card is present for specific transactions, businesses can quickly confirm both the authenticity of the transaction and the identity of the person attempting to make it. Many banks also integrate credit card scanning in their mobile apps for plain convenience, enabling easy payments and transfers directly from users’ bank accounts.

Healthcare providers, finally, are adopting digital payment solutions including credit card scanning to simplify billing for patients. This reduces the administrative overhead and improves cash flow by facilitating quicker payments and minimizing billing errors.

Benefits

Convenience is key. It is the main reason why shoppers buy goods online. This especially applies to the checkout process: Customers expect it to be simple. Any extra step or form field can lead to abandoned carts and lost conversions. A frictionless payment process, however, enhances the customer experience and encourages repeat customers.

With a credit card scanner SDK in your mobile app, your customers can instantly capture their card details using their smartphone camera, streamlining the checkout process. This eliminates the need for manual entry, saving them the effort of entering payment information manually and minimizing the chances of errors.

For businesses, mobile credit card scanning technology streamlines administrative and transaction processes and reduces the dependency on physical card readers. Shifting to mobile also boosts operational efficiency by speeding up the checkout process for customers – and also minimizes the risk of payment errors, leading to fewer chargebacks.

A technology comparison: Hardware vs. software

There are several ways to integrate credit card scanning into your payment process. Let’s explore different hardware and software options:

Hardware devices

Hardware-based credit card scanners are tangible devices. They often have a wired connection to the main payment system, but may also work wirelessly.

Let’s have a look at the most common types:

- Magstripe readers capture data from the magnetic stripe on the back of credit cards and are commonly used in older systems. However, their security is lower compared to newer methods, as the data can be easily copied.

- Europay, Mastercard and Visa (EMV) or chip card readers require the card to be inserted. By working with the card’s embedded chip, they offer more secure transactions through encrypted data and dynamic transaction codes. Today, they are standard for in-person payments in most parts of the world, including in retail.

- Near Field Communication (NFC) or contactless card readers facilitate quick payments using smartphones or cards. They protect transactions through encryption and tokenization, and are common in fast-paced environments like quick-service restaurants.

Hardware card readers also differ in how mobile they are:

- Bluetooth card readers work in tandem with mobile devices to enable wireless payment processing, making them ideal for mobile point of sale (mPOS) applications. These devices are particularly useful for merchants who need to accept payments on the go, such as at events or in quick-service environments.

- USB card readers plug into computers or POS systems, supporting magstripe, EMV chip, and sometimes NFC technology, typically used in fixed locations. How secure they are depends on the technology employed.

While hardware-based credit card readers have been around for some time, they are not always the most convenient option. They are typically designed for stationary setups, meaning they are not suitable for dynamic environments where transactions need to be processed on the move.

In these cases, mobile-friendly solutions, like credit card scanners in apps, provide greater flexibility and adaptability.

Software solutions

Software solutions, especially software development kits (SDK), offer a more flexible alternative to data extraction hardware. Unlike hardware devices, SDKs can be embedded into your own app or web environment. This host app operates on devices that businesses or customers already use, such as smartphones or tablets. Opting for SDKs thus eliminates the need to purchase additional hardware.

There are four main options:

- Custom development may be necessary for businesses with very specific requirements or unique workflows. However, creating your own solution demands substantial amounts of time, resources and technical expertise in OCR and machine learning.

- API integration facilitates the extraction of credit card data without building a complete solution from scratch. While it simplifies many aspects of development, additional coding is still required for integration, error handling, and ensuring security compliance.

ML Kit, for example, provides a Text Recognition API that developers can use to build applications capable of recognizing text from images, including credit card information. However, it does not come with pre-built features for credit card scanning. This means that developers need to write additional code to parse the extracted text, identify relevant fields, and perform all necessary validation or formatting.

- Open-source software is technically a cost-effective solution for developers looking to integrate scanning capabilities without incurring licensing fees.

However, open-source solutions frequently lack essentials like enhanced security or support. Also, code maintenance is not ensured. If a project is no longer actively updated, developers are left at risk of their solution becoming non-functional.

- Paid SDKs typically offer specialized and robust features, dedicated support, and enhanced security compared to open-source solutions. They are designed with compliance in mind, ensuring adherence to standards such as PCI DSS, which is crucial for protecting sensitive payment information.

Find out more about the Scanbot Credit Card Scanner SDK.

Considerations when choosing a solution

Before you decide on a credit card scanning solution, it is important to consider various factors:

- Accuracy: Make sure the solution delivers high-quality scanning to minimize data extraction errors. High-quality data capture ensures that the data can be processed reliably.

- Speed: Choose a fast solution to enhance the customer experience. The goal is to make the user’s life easier by reducing friction during transactions.

- Compatibility: Ensure that the solution is compatible with your existing systems to prevent integration issues.

- Integration and support: Take into account the provider’s developer support and documentation. They are essential to get your solution up and running fast.

- Pricing: Commercial scanning solutions either come with variable or flat pricing. If your scan volume is certain to be low, a volume-based pricing structure may be more cost-effective. However, if you anticipate a high number of scans, flat-rate pricing may be a better option, as it guarantees unlimited scanning without cost increases.

Security considerations

As credit cards contain sensitive information, it is vital that this data is protected and security standards are respected. Look for the following practices when choosing a provider:

- Compliance with PCI DSS standards is mandatory for all organizations that handle credit card information.

- Data encryption transforms sensitive data into unreadable code, making it inaccessible to unauthorized users.

- Tokenization replaces sensitive card information with a unique identifier or token that has no exploitable value. This reduces the impact of data breaches significantly.

- On-device data processing refers to data being handled on the device directly instead of transmitting it over networks.

Overall, it is essential to thoroughly test before fully deploying the solution. This helps with identifying potential issues, ensuring smoother implementation, secure processing, and reliable performance.

A look into the future

Driven by the desire for convenience, consumer behavior is changing. Mobile payment is becoming more popular by the day, especially among under 50-year-olds: In the U.S., 91% already use their smartphone to make online purchases, and they do so more and more often. This drives a need for efficient, user-friendly checkout processes.

In the quest to minimize cart abandonment, simple credit card scanning has a major role to play. This is not least because credit cards will stay the preferred payment method in the U.S. This year alone, credit cards accounted for 77% of all non-cash transactions. However, acceptance of digital and cardless payments is expected to expand significantly. As consumers become more comfortable with these technologies, the use of physical credit cards may decline in favor of mobile wallets and other digital payment methods.

As for scanning technology, we can expect technological evolution in AI and machine learning over the next years, further enhancing the user experience and security of solutions. Data protection, of course, stays the main priority for businesses handling sensitive data such as credit card details.

Conclusion

As mobile payment adoption continues to grow, businesses have to optimize the mobile checkout experience in their apps. By adding credit card scanning, they can dramatically simplify the checkout process and so reduce cart abandonment.

A scanning solution not only enhances customer satisfaction, but it also improves operational efficiency by speeding up data entry and minimizing errors.

Thinking about integrating a credit card scanner into your app? Let’s talk!