Credit Card Scanner SDK

Extract data from credit cards as key-value pairs

(Note: Credit card scanning is currently in beta. To access the native Android/iOS SDK, contact sdk@scanbot.io)

Trusted by

300+

global

industry leaders

Fast, secure, and easy-to-use credit card scanning

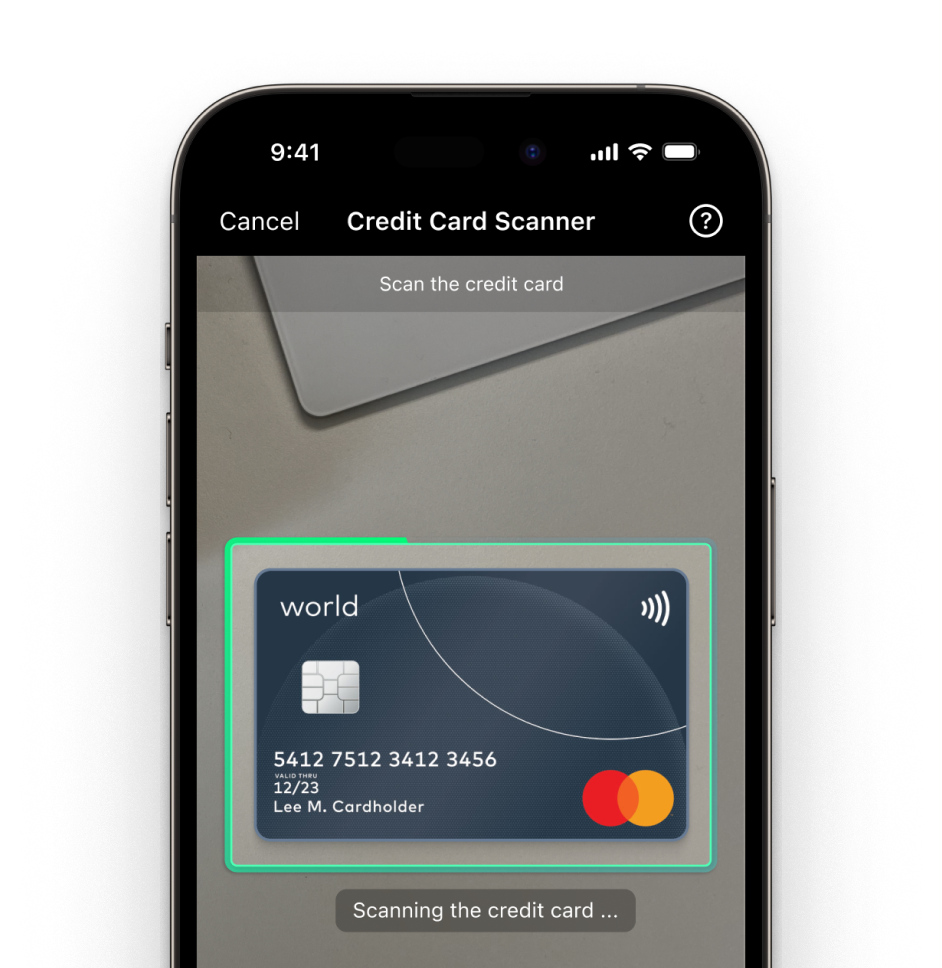

With the Scanbot Credit Card Scanner SDK, you can quickly and reliably extract data from credit cards. Integrate the SDK into your mobile application and read cards instantly – no more typing.

Our credit card scanning software automatically extracts the card number, cardholder name, and the expiration date. It returns key-value pairs, which your app can process easily. This simplifies workflows for both your customers and your employees, preventing errors and saving time.

The entire scanning process happens offline on the device, with zero server connections. Sensitive payment details stay completely safe.

The SDK will initially support Android and iOS, with other platforms to follow soon. To stay posted, subscribe to our monthly product newsletter!

Scan and extract data from credit cards

The Scanbot Credit Card Scanner SDK supports multiple payment card types, including Visa, Mastercard, and American Express. It extracts the following key bank card information:

- Card number (PAN)

- Cardholder name

- Expiration date

Frequently Asked Questions

Where is a credit card scanner SDK used?

Key applications include retail, e-commerce, banking, healthcare, and hospitality. In retail, scanning streamlines omnichannel shopping and self-checkout. Banks use it to reduce fraud and simplify app payments, while healthcare organizations can improve billing accuracy and cash flow. In travel and hospitality, it simplifies bookings for flights, hotels, and car rentals.

Why add a credit card scanner SDK to your app?

It improves the customer experience. In-app credit card scanning is faster, more convenient, and more accurate than having users manually enter card details. Less friction improves conversions - at checkout, for instance, it helps prevent cart abandonment.

How does integrating a credit card scanner benefit users?

By allowing users to scan their credit card details instead of entering them manually, you save time and effort while minimizing errors. This not only simplifies the payment process, but also boosts customer satisfaction, making the entire transaction faster and more enjoyable.

Why go with an SDK to integrate credit card scanning?

Building a scanner in-house is time-consuming and costly. SDKs allow rapid development. Moreover, modern SDKs often provide customization options, allowing developers to seamlessly integrate the scanner with the app’s design.

How does the Scanbot Credit Card Scanner SDK work?

Our SDK enables users to quickly scan credit cards using their smartphones. The SDK uses OCR and machine learning to find and extract information. The resulting key-value pairs can then be processed automatically in the backend.

As the Scanbot SDK operates entirely offline, no data ever leaves the device. It therefore also complies with both the GDPR and the CCPA and is ideal for handling sensitive data.

Does the Scanbot Credit Card Scanner SDK need an internet connection?

No, the Scanbot SDK doesn’t need an internet connection: It runs offline and stores no data. This guarantees compliance with all privacy and data security standards.

Can I scan all bank cards with the Scanbot Credit Card Scanner SDK?

Currently, the Scanbot SDK supports Visa, Mastercard, and American Express credit cards in landscape orientation only. It does not support debit card scanning.

Which platforms will the Scanbot Credit Card Scanner SDK be available for?

Our credit card scanner module will be available for integration in Native Android or iOS apps. Other platforms will follow soon after. Stay up to date about new releases by subscribing to our newsletter!