Paper checks remain vital to global banking. With every check you deposit, you’re relying on a decades-old technology that still powers automated clearing systems worldwide: Magnetic Ink Character Recognition, or MICR.

Since 1959, MICR (pronounced “micker”) has been the backbone of check processing, enabling banks to handle millions of transactions with remarkable speed and accuracy. Here’s everything you need to know about MICR Codes and why this technology continues to matter.

What is a MICR Code?

A MICR Code is a unique, machine-readable identifier printed at the bottom of most bank-issued checks. Think of it as a check’s fingerprint – a standardized way for banks to instantly recognize where a check originates and where funds should flow from.

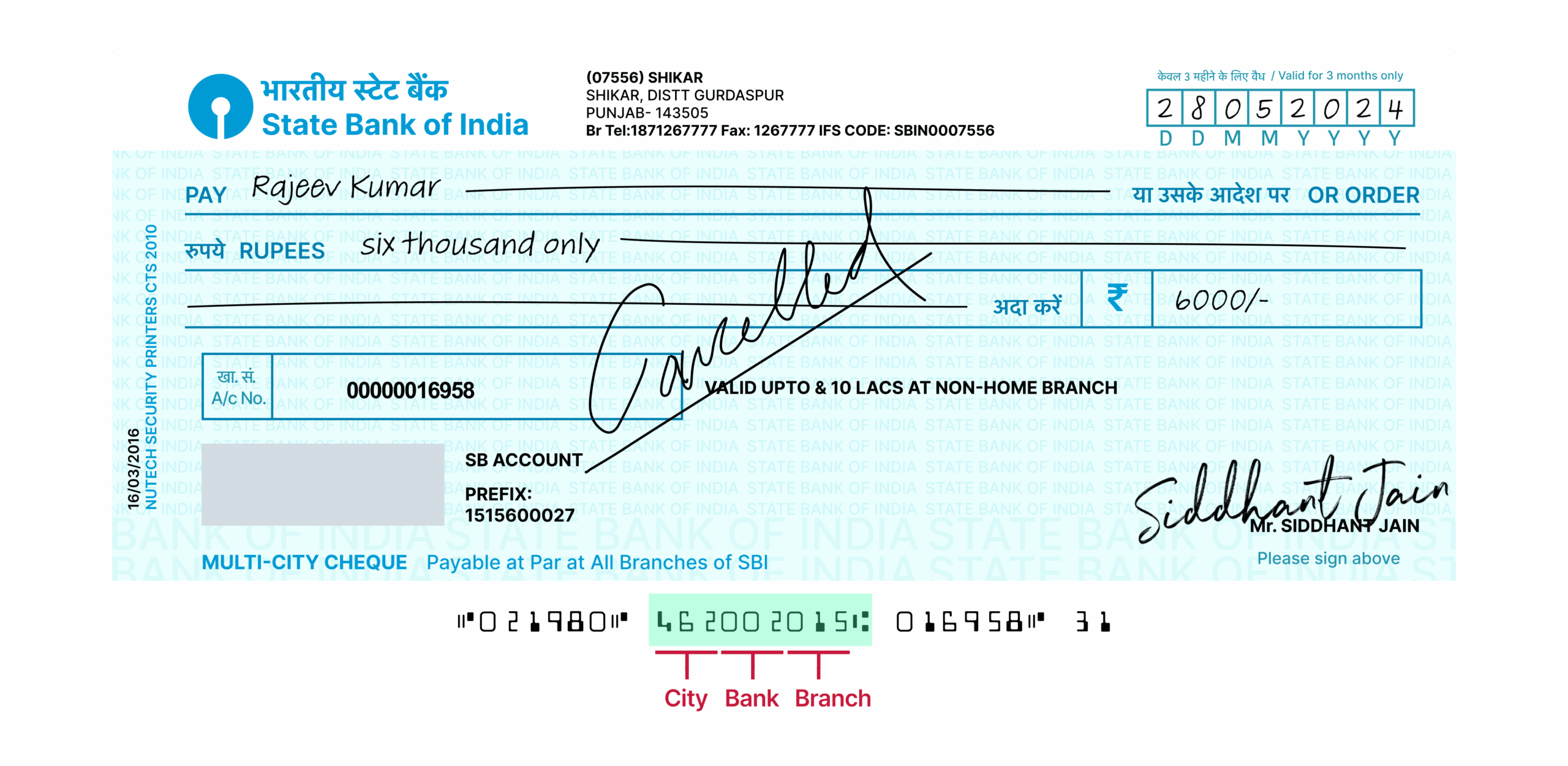

The exact layout of the whole MICR line varies from country to country. On checks issued in India, for example, the line begins with a check number. This is followed by the MICR Code proper, which is a bank branch identifier.

This nine-digit MICR Code breaks down into three key components:

- First three digits: the city where the bank branch operates

- Next three digits: the specific bank

- Final three digits: the particular branch

For example, the MICR Code 560002055 tells banks they’re processing a check from the State Bank of India’s Yeswantpur branch in Bangalore. This instant identification makes automated clearing possible.

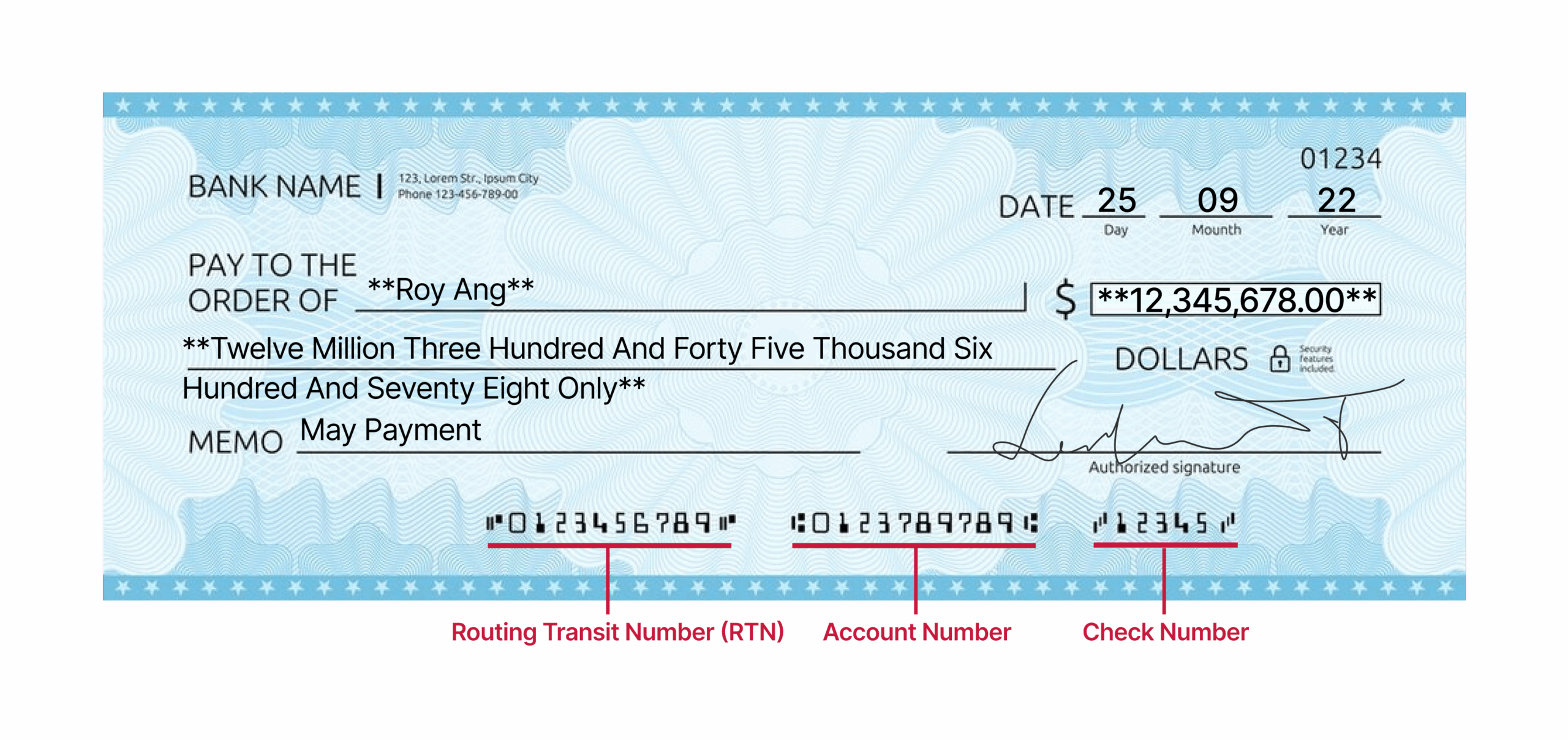

MICR Codes in the United States

US checks begin with a similar nine-digit code, the Routing Transit Number (RTN), issued by the American Bankers Association (ABA). The US MICR line typically has three main fields, all printed in E-13B font:

- Routing transit number: 9-digit code identifying the financial institution

- Account number: Identifies the customer’s specific account

- Check number: Tracks individual checks for the account

What is MICR technology?

MICR – Magnetic Ink Character Recognition – combines two specialized elements: magnetic ink and standardized fonts. Together, they create characters that machines can read with extraordinary reliability and speed.

Magnetic ink

MICR characters aren’t printed with ordinary ink. Instead, they use ink or toner containing iron oxide – the same material used for cassette tapes. When a check passes through a magnetic field, these iron oxide particles become temporarily magnetized, allowing machines to detect and read the characters.

This magnetizable property is what makes MICR fundamentally different from optical scanning (OCR technology).

MICR fonts

The magnetizable ink works in tandem with standardized MICR fonts. While there is no international agreement on which countries use which font, there are two common ones, each with their own characteristics:

| Feature | E-13B | CMC7 |

| Character set | 14 characters: 10 digits + 4 special symbols (⑆ Transit, ⑈ On-Us, ⑇ Amount, ⑉ Dash) | 10 digits + 26 capital letters + 5 control characters |

| Reading method | Produces a continuous magnetic waveform read from left to right | Functions more like a magnetic barcode, consisting of bars and gaps |

| Design | Characters have exaggerated features that produce distinct magnetic patterns | Each character is made of 7 bars with 2 wide gaps between groups |

| Used in | Australia, Canada, UK, US, Central America, much of Asia | Europe, Mexico, South America |

| ISO standard | ISO 1004-1:2013 | ISO 1004-2:2013 |

| Image |

E-13B is the more common font worldwide. Its characters have exaggerated features that produce distinctive magnetic waveforms when scanned.

CMC7 functions like a barcode system, with gap patterns that machines can easily distinguish. It offers more flexibility with its expanded character set, including alphabetic characters.

The MICR reading process

When you deposit a check, it goes through a three-step process in a dedicated reader:

Step 1: Magnetization

The check passes under a magnetizing head that polarizes the iron oxide particles in the ink of the MICR line.

Step 2: Signal reading

As the magnetized check moves past a magnetic read head – similar to a tape recorder’s playback head – each character generates a unique waveform based on its shape and ink density.

Step 3: Character Recognition

The reader’s electronics analyze these waveforms, compare them against known templates, and translate them into digital characters.

Modern scanners often pair this magnetic reading with optical imaging to create a complete digital copy of each check for archiving.

What are MICR Codes used for?

MICR Codes serve several critical functions in banking operations:

- Automated check clearing and routing

Banks use MICR Codes to quickly and accurately identify accounts for crediting or debiting funds. MICR readers are the primary tool for check sorting and are deployed across the check distribution network at multiple stages.

Beyond domestic transactions, MICR Codes also facilitate cross-border clearing systems, giving them broader reach than other identifiers such as the Indian IFSC codes.

- Branch and bank identification

MICR Codes identify the issuing bank and branch, ensuring that funds from a check are routed properly to the correct financial institution and account. This eliminates ambiguity and speeds up processing.

- Fraud prevention and authentication

The combination of magnetic ink and standardized fonts makes checks harder to forge, alter, or tamper with. Even when covered with stamps or signatures, magnetic reading can still recognize the printed data, providing an additional security layer against counterfeiting.

- Legacy compatibility and document tracking

Although many banking systems have shifted to digital operations, the MICR line remains essential for physical check processing, archiving, imaging, and historical bookkeeping. MICR reading enables transaction validation, compliance monitoring for paper-based payments, and maintains compatibility with decades of banking infrastructure.

Scanning MICR Codes with the Scanbot Check Scanner SDK

While traditional MICR readers remain an important tool for check sorting across the distribution network, many banks no longer return physical checks to customers. Instead, checks are scanned, processed, and stored digitally. This is known as check truncation.

The Scanbot Check Scanner SDK makes that process simple. Integrated in your application, the SDK uses optical character recognition (OCR) to let users capture the complete MICR line, including:

- Check number

- MICR Code / Routing Transit Number (RTN)

- Account number

- Transaction code

Depending on the check type, it can also extract:

- Sort Code

- (Extra) Aux Domestic

- BSB

- Serial Number

- Auxiliary On-Us

The Check Scanner SDK supports both E13B and CMC7 MICR fonts and is available for Web, Android, iOS, React Native, Flutter, Capacitor, .NET MAUI, and Cordova.

Interested in trying our solution for yourself? Request a free 7-day trial license or test our demo app.

FAQ

What is the difference between MICR and IFSC?

The MICR Code is a machine-readable identifier printed on checks using magnetic ink to enable automated processing and clearing.

The IFSC code (Indian Financial System Code), on the other hand, is an alphanumeric identifier used for online fund transfers such as NEFT, RTGS, and IMPS.

Where can I find the MICR Code?

The MICR Code is printed at the bottom of most bank-issued checks in India, near the check number. It can also be found on:

– The first page of your checkbook

– Your bank account statement

– Your bank’s online portal or mobile app

What does TOAD line mean?

The TOAD line refers to the four special symbols used in the E-13B MICR font:

– T – Transit (⑆)

– O – On-Us (⑈)

– A – Amount (⑇)

– D – Dash (⑉)

These symbols separate different fields in the MICR line on a check, such as the routing number, account number, and check number, making them easier for machines to read.

What is an ABA routing transit number (ABA RTN)?

In the United States, an ABA routing transit number (RTN) is a nine-digit code printed in the machine-readable MICR line of checks. It identifies the financial institution that issued the check and ensures accurate routing during processing and clearing.

Which check formats does the Scanbot SDK support?

The Scanbot SDK supports a variety of check formats. It scans both the E-13B and the CMC7 MICR fonts. It is compatible with the check standards used in:

– the United States: compatible with the ASC X9 standard

– France: compatible with the NF K11-111 standard

– Kuwait: compatible with the Kuwait Electronic Cheque Clearing System standard

– Australia: compatible with the Australian Paper Clearing System check standard

– India: compatible with the CTS-2010 standard issued by the Reserve Bank of India

– Israel: compatible with the Bank of Israel Banks’ Clearing House rules

– the United Arab Emirates: compatible with the Central Bank of the UAE Image Cheque Clearing System

– Canada: compatible with the Payments Canada Standard 006

Need support for a different check standard? Get in touch to discuss the options!